Ask an investment manager what their number one concern for their portfolio is and the term “risk” is likely to come up. The past few years have shown that capital markets investors must “expect the unexpected”, all the way from black swan events like Covid-19, to social media driven short squeezes, to regime shifts from momentum stocks to mean reversion. Risk is everywhere: the 2022 Natixis Institutional Investor Survey says that investment managers are concerned about many kinds of risk, like inflation and interest rates, speculative valuations and volatility, and even ESG concerns. To stay ahead, asset managers need to find novel and data-driven ways to hedge their risk.

How do investment managers typically hedge risk?

Today, most investment managers hedge their portfolio risk either by shorting a basket of stocks provided for them by a third party or shorting an index (like the S&P500 or the Russell 1000).

There are a number of problems with this method:

- The basket of stocks or index is not unique to the investment manager. Why would an asset manager, who takes such painstaking care of their portfolio, individually researching stocks to buy/sell or short, settle for a hedge that wasn’t custom curated to their needs? The job is typically outsourced because building sophisticated hedging functions in-house are time and resource intensive.

- The intense resources it takes to create unique hedges leaves many asset managers resorting to simple beta hedging.

- Because these hedges aren’t unique to each individual institutional investor client, there is the potential for short squeezes, where an overcrowded short can be driven up in price quickly, eroding any potential gains for the manager

- It is hard to offset non-intuitive risks and generate excess return using generic hedge baskets.

How can investment managers future-proof their hedge baskets?

There’s a better way for active asset managers to create their own hedge baskets. Asset managers – especially ones that actively manage equities – know that harnessing the power of big data will be key to future success. Institutional Investor reports that managers and banks are making significant investments in their data science capabilities, believing that seizing on data-driven insights will help drive success for their portfolios. In the same article, a Northern Trust survey of 300 asset managers showed that 98% of respondents “are currently using, planning to adopt, or are interested in incorporating data science tools into their firms’ investment strategy in the next one to two years.”

Data-driven hedges will be the way all asset managers curate their short books. Artificial intelligence helps portfolio managers corral the world of big data into meaningful insights, learning from decades of data to produce both intuitive and non-intuitive results that are most importantly, performant. Some of the benefits of using AI to curate unique-to-them data-driven hedge baskets for asset managers are:

- Hedge baskets that are completely unique to the user, for single stocks or a basket of stocks.

- Having fully backtested results, which highlight how the hedges would have performed, giving the investment manager confidence in the hedge basket.

- Creating bespoke hedge baskets allows asset managers to find optimal hedge baskets that can outperform shorting ETFs or indexes

Boosted.ai Hedge Baskets

Here at Boosted.ai, we always ask our clients (that range from small family offices to companies with over $1 trillion in AUM) what they need first. That is what has pushed our best product updates, like stock and portfolio one-pagers (giving managers a bird’s eye view of their AI models), extremely explainable AI (lending PMs greater confidence in their machine learning models), and incorporating semantic risk factors (offering a clearer picture on how their AI models work).

Our newest feature, Hedge Baskets, was created to solve the need for unique, performant, quick, executable hedges for investment managers. Here are some of the ways our Hedge Baskets can help different types of institutional investors.

How does AI-powered hedging benefit Portfolio Managers?

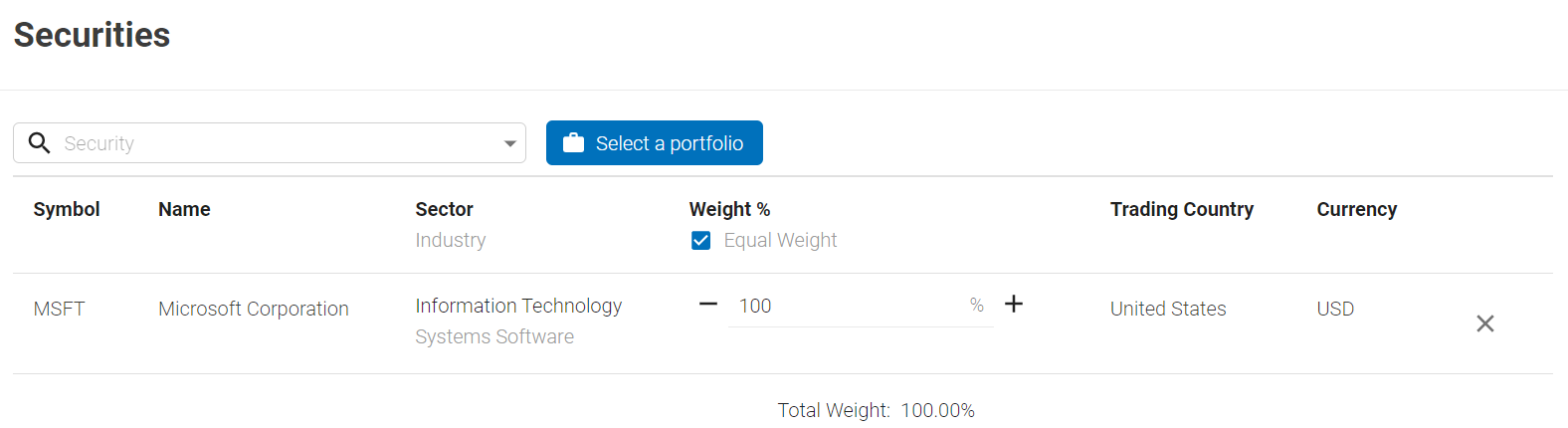

Because PMs are so time constrained, they do not have a lot of time to dedicate to optimizing their hedge baskets. They just want something that works (and performs), which is why they tend to opt for short ETFs or indexes, or purchase a generic short basket. They leave money on the table to save time. By using Boosted.ai Hedge Baskets, PMs can create their own hedge baskets within hours, completely unique to them and their investment mandate. These smart hedges can offset overexposure to certain positions, protect against downside risk, reduce volatility and beta in their portfolios, and generate higher portfolio returns than a simple beta hedge.

How can data-driven hedges help Risk Managers?

Risk Managers are extremely diligent with optimizing the hedge baskets they create, but are limited by the lack of transparency and control of their hedging process. Using Boosted.ai Hedge Baskets puts the power back in the RMs hands. It enables them to build, backtest and optimize AI-powered hedge baskets in-house and gives them the freedom to choose the best execution vehicle for the job.

How can Quant PMs and Analysts use smart hedge baskets?

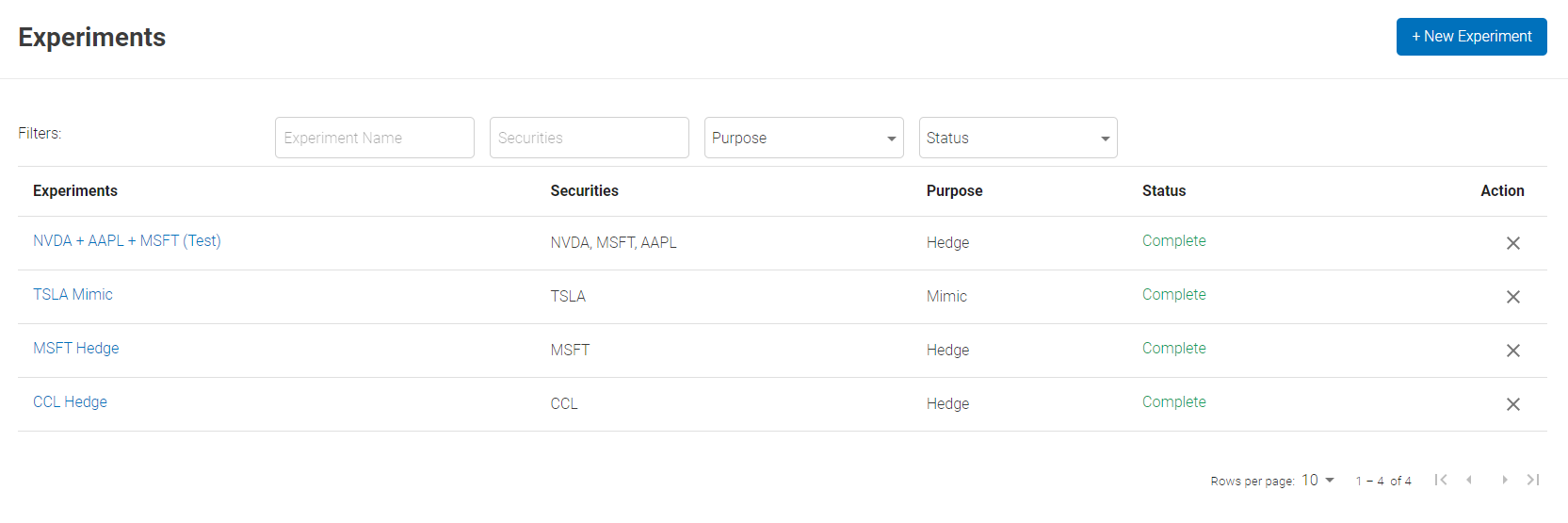

At smaller quant shops, these folks have to balance multiple roles, which makes hedging a painful process, as quant derived hedges can be manual and time consuming to set up and backtest. Finding the best hedge baskets can take days when setting up the myriad combinations of models, universes and scenarios. The Boosted.ai Hedge Baskets tool allows these portfolio managers and analysts to save hours (if not days) by enabling them to create and backtest multiple hedge baskets in a single experiment. These backtested results can help them find the most performant hedge baskets for their needs.

How can Traders use the power of intelligent hedging?

Traders that are tasked with hedging out stock risk often rely on third parties to do so. This can lead to information leakage, which can leave the trader in a worse position. With Boosted.ai Hedge Baskets in their arsenal, traders can easily (and quickly) generate performant hedges without needing to consult anyone else. They now have the flexibility to select their preferred route of execution while keeping their intentions entirely internal to their firm.

Boosted.ai Hedge Baskets at work

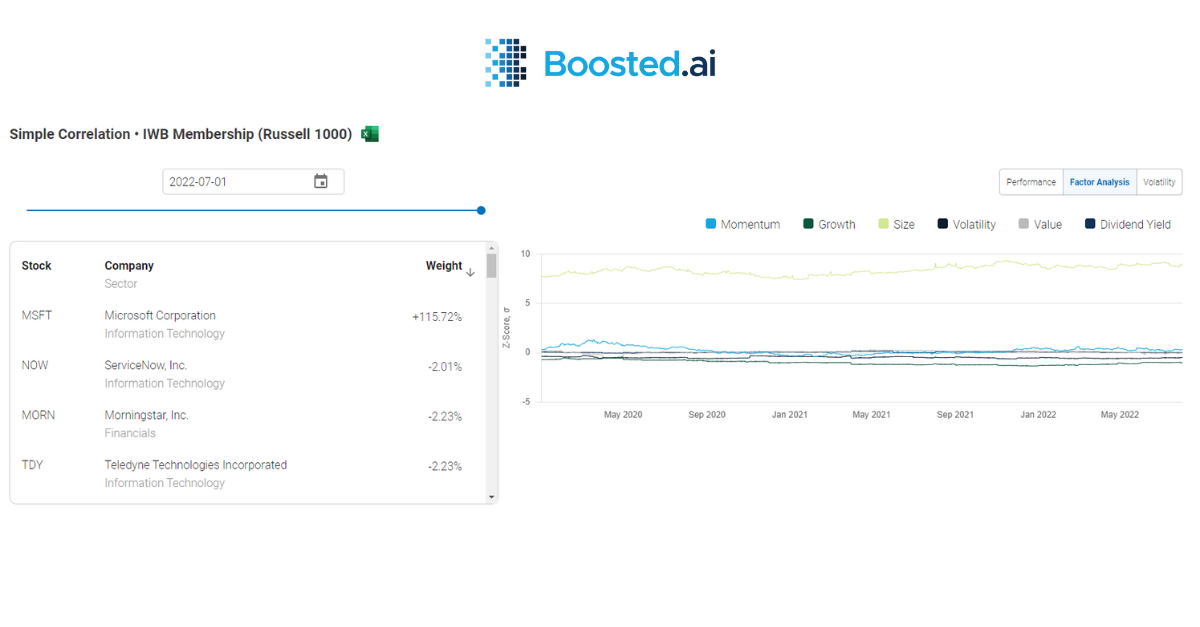

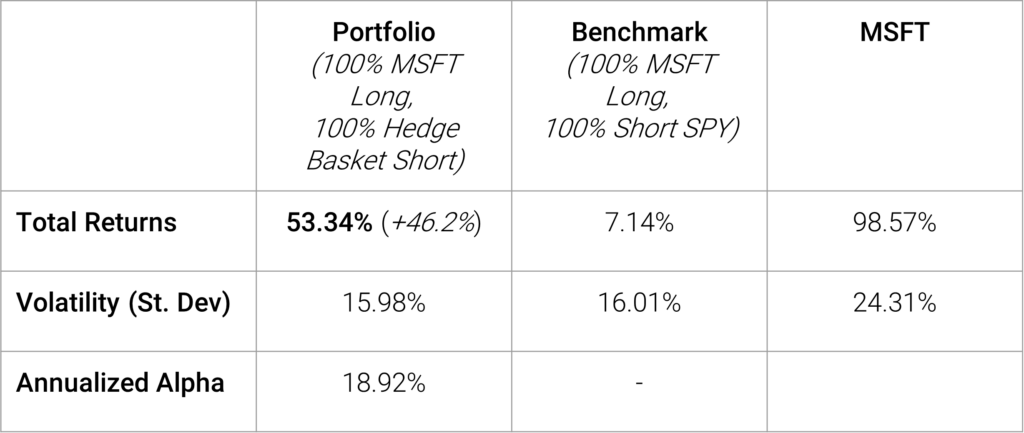

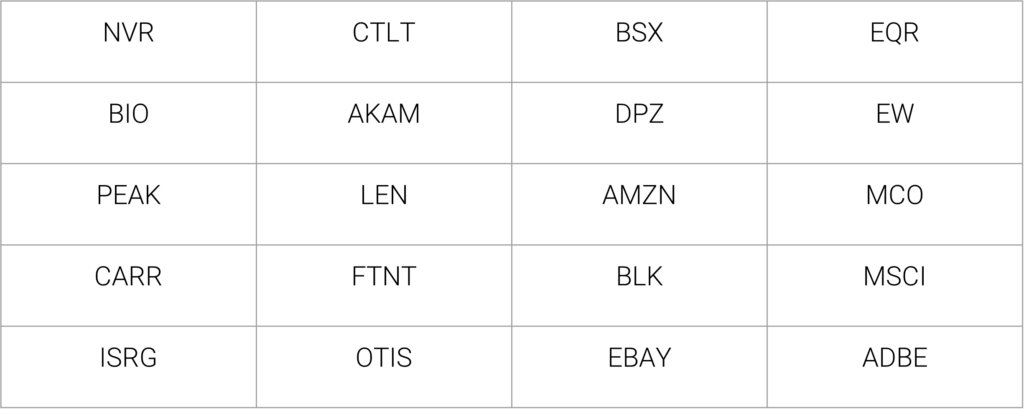

Here is an example of how using Boosted.ai Hedge Baskets was more beneficial than simply shorting SPY, using Microsoft (MSFT) as the target stock to hedge. Using our smart hedging capabilities, this intelligent, data-driven hedge produced alpha over the benchmark, while keeping volatility flat versus SPY.

Takeaways

Bespoke, data-driven hedges can help institutional investors avoid overexposure, protect against downside, reduce volatility and beta in their portfolios and generate higher portfolio returns than simple beta hedges. As the world continues to adapt to new technologies, AI capabilities will continue to be a differentiator for forward thinking asset managers. If you’d like to learn how you can use Boosted.ai Hedge Baskets in your investment process, please reach out to us here.