Easily generate Hedge Baskets unique to your portfolio

Intelligent

Leverage machine learning to find single stock hedges that offset idiosyncratic risks unique to your portfolio

Transparent

Own your hedging process and ensure performance with multiple years of backtesting

Performant

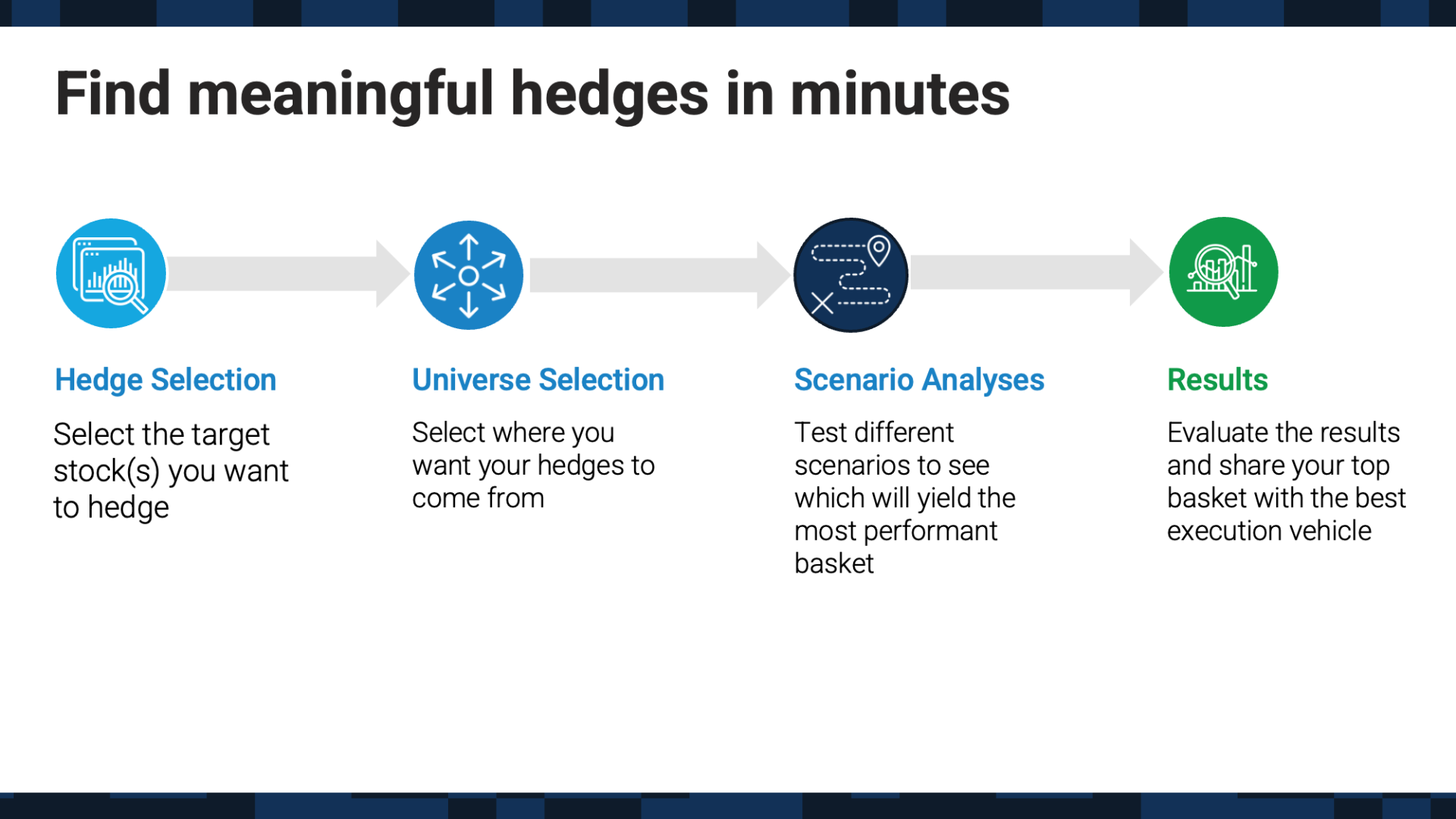

Easily conduct scenario analyses to find optimal hedge baskets that outperform shorting ETFs/indexes

Why is it hard to find performant, single-stock hedges unique to you?

Outsourced

Portfolio Managers and Risk Managers often outsource their hedging process

Intensive

Building a sophisticated hedging function in-house is time and resource intensive

Complex

Finding similar stocks to hedge is complex, so asset managers resort to simple beta hedging

Generic

It is hard to offset non-intuitive risks and generate excess return using generic hedge baskets

Power of Intelligent Hedging at your fingertips

Smart Hedging at work

Bespoke, data-driven hedges can help institutional investors avoid overexposure, protect against downside, reduce volatility and beta in their portfolios and generate higher portfolio returns than simple beta hedges. As the world continues to adapt to new technologies, AI capabilities will continue to be a differentiator for forward thinking asset managers.

Hear from the experts

In this joint webinar with S3 Partners, our CEO and Co-founder, Joshua Pantony and S3 Partner’s Managing Partner and Founder discussed how investment managers can seize on the power of data-driven AI and alternative data to control their portfolio risks.

In this joint webinar with S3 Partners, our CEO and Co-founder, Joshua Pantony and S3 Partner’s Managing Partner and Founder discussed how investment managers can seize on the power of data-driven AI and alternative data to control their portfolio risks.