We have spent years honing Boosted Insights – our artificial intelligence platform purpose build for asset managers – based on client feedback. We’ve made explainable, glass-box improvements to help asset managers have complete clarity into all trade recommendations, we’ve added smart hedge baskets that incorporate data-driven AI into the process, and we created stock one-pagers to help investment managers see everything about an individual stock at a glance. All these improvements have made Boosted Insights an extremely powerful AI-powered asset for investors, but we have heard from some folks that they still don’t see a clear path to incorporating artificial intelligence easily and successfully.

One of the biggest roadblocks we have heard clients run into is that adopting something as advanced as artificial intelligence can feel too complicated. In an effort to simplify the output (actionable insights) of Boosted Insights, we have shifted the input (complex and robust machine learning algorithms paired with data scientist and finance expert built ML models) to over-the-counter AI strategies. Our strategies are a library of investment strategies, available at the click of a button, in our newest update, Boosted.ai 2.0.

Boosted.ai 2.0

Simplicity is at the core of Boosted.ai 2.0. Every screen has been reformatted – after thorough sessions with our users – to get asset managers to the screens they care about faster and easier. And though we keep evolving on the backend too – keeping our teams of data scientists, finance experts and engineers busy as ever, the focus is on making their work as actionable as possible. To that end, we now highlight three main screens on Boosted Insights: Ideas, Watchlists and Strategies.

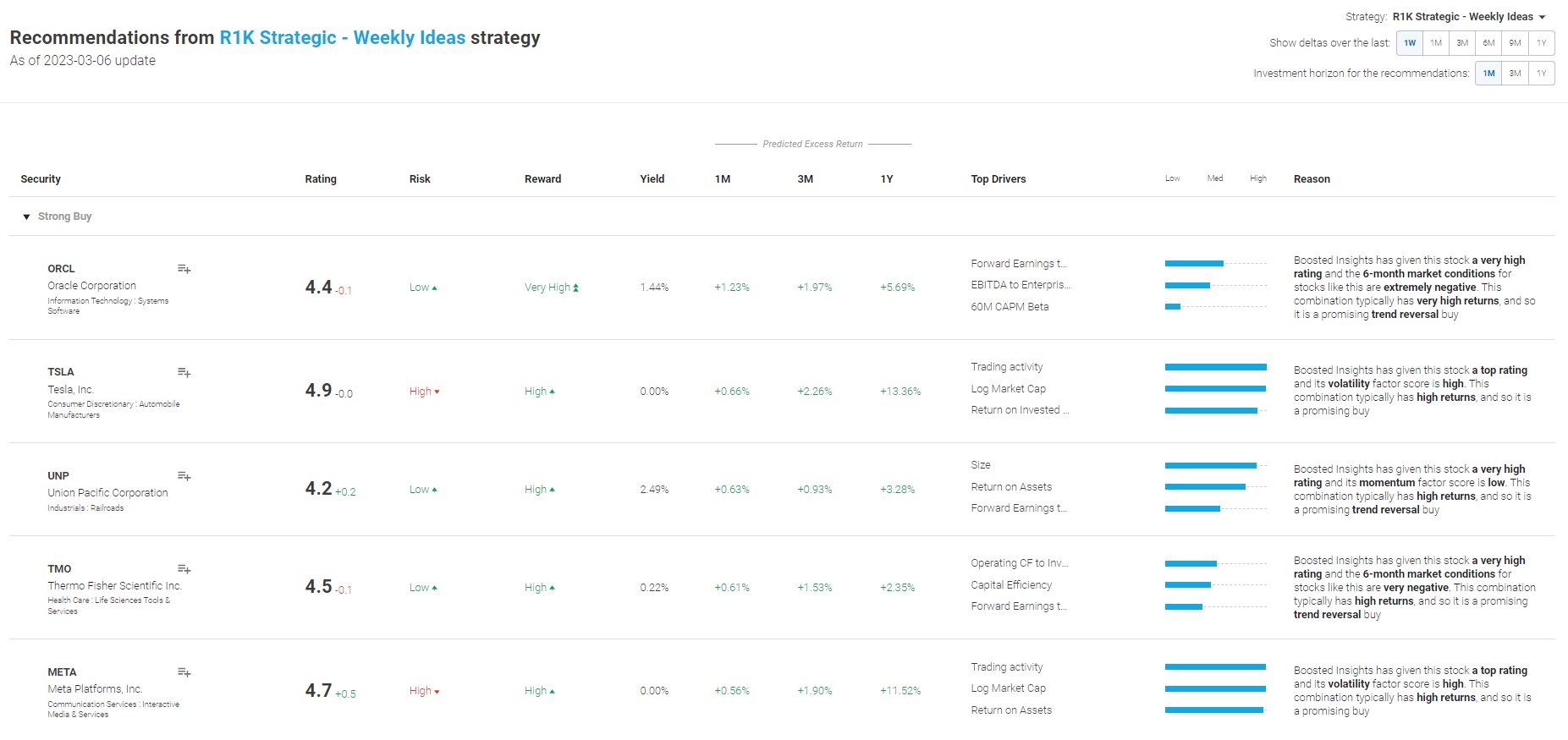

Ideas

Ideas populates new, sometimes unintuitive single stock ideas for investment managers to investigate further. The reason the AI strategy recommends the stock is explained in clear and concise language, along with the equity’s stock rating, risk and reward profile and predicted excess returns. Users can navigate to the Ideas page for compelling trade possibilities to bring clients and teams.

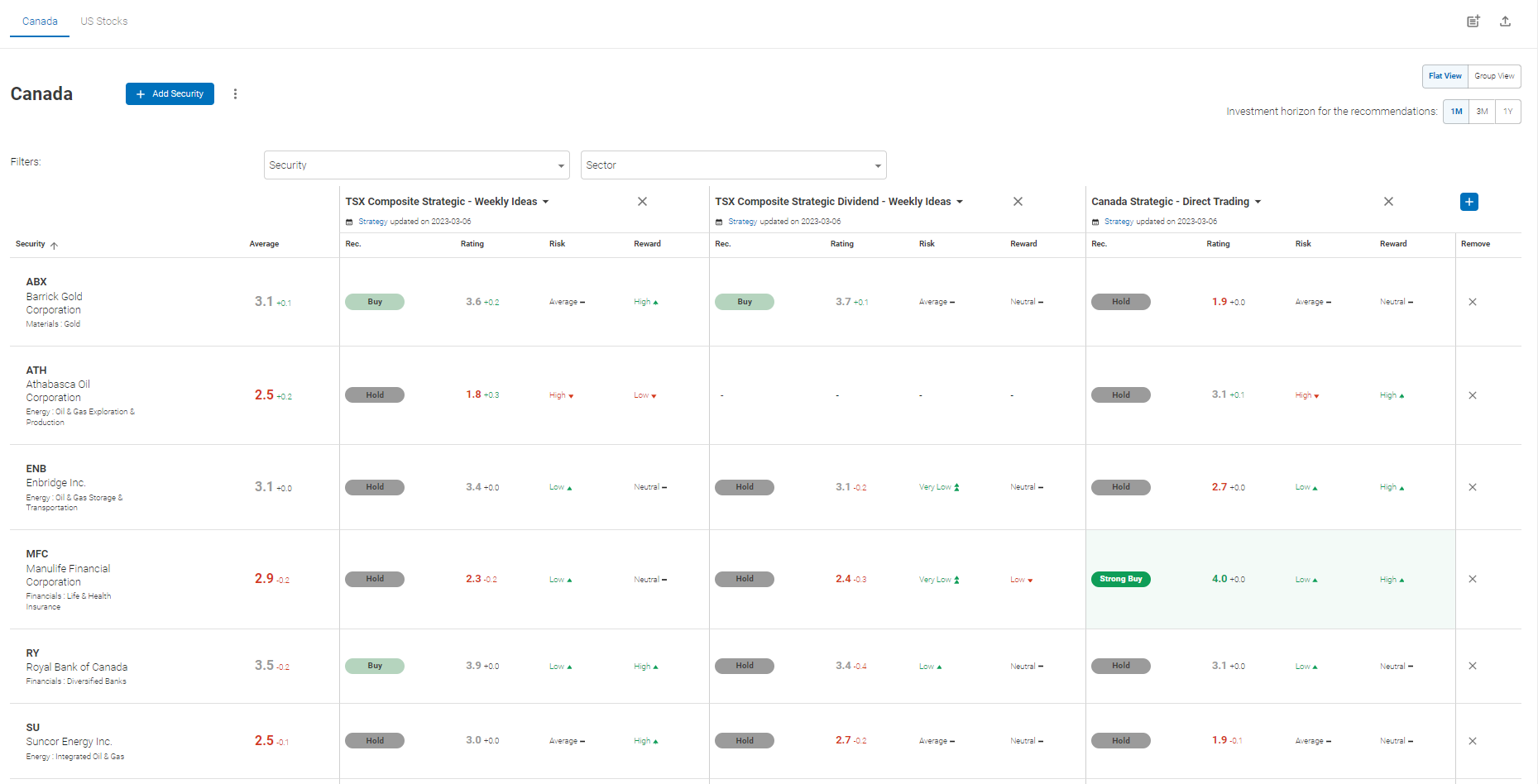

Watchlists

Watchlists curates a view of stocks the portfolio manager cares about into one screen, with different strategies highlighting different actions they can take. This page is where asset managers can get a broad understanding of their stock universe, from multiple angles. For example, a user might want to add a tactical and a strategic weekly ideas strategy, to see where the data agrees, where it differs, and what might look like an interesting opportunity, based on their own investment expertise.

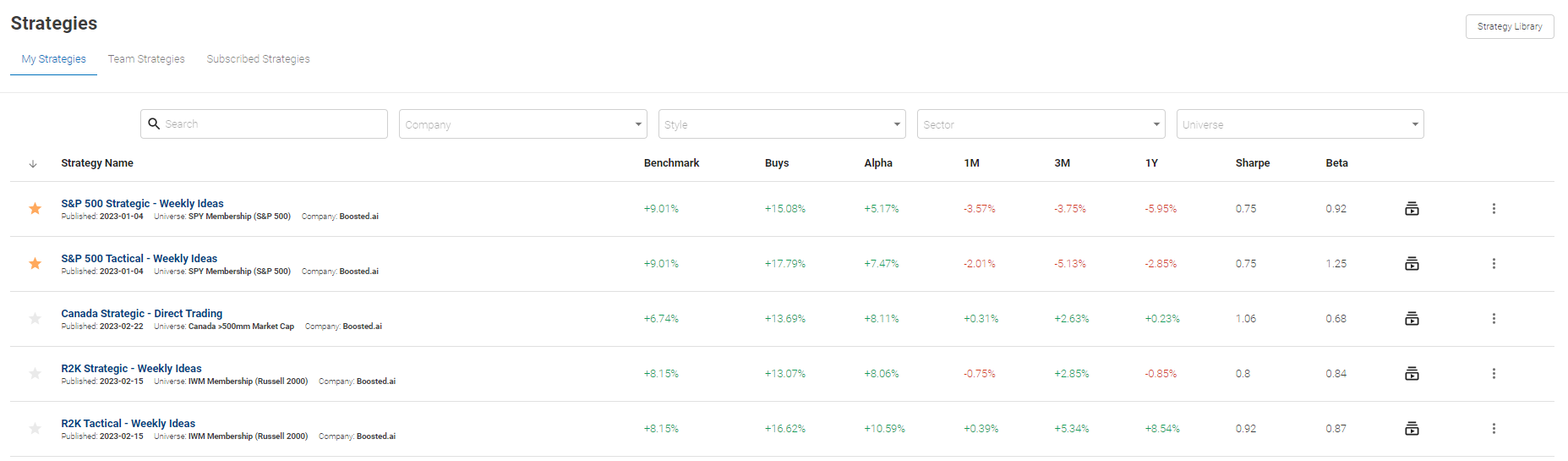

Strategies

Strategies are at the heart of the new Boosted.ai 2.0 – we now have a series of strategies, honed by finance experts and data scientists, that asset managers can subscribe to, all tailored to their point of view on capital markets. These strategies give weekly ideas to help drive value for every kind of investment manager.

Boosted.ai 2.0 for investment advisors

Since we’ve been providing institutional investors with cutting-edge artificial intelligence, we have heard from a great deal of investment advisors that are interested but cannot handle the restrictive capital expenditure that investing in AI can take. We have launched Boosted Insights for IAs, a scaled down version of the platform, to help IAs achieve their AI goals. Though the IA version does not include the highly personalized customer success management that our enterprise tier does (users in our enterprise levels get 1:1 customer success managers that work with them to create custom strategies that exactly match their needs), our IA clients have already seen great success in adapting the AI insights to their clients’ portfolios.

Takeaways

The CFA Institute has identified five major hurdles for investment firms when trying to realize the full potential of using AI and big data: time, vision, technology, talent, and cost. Boosted.ai 2.0 solves for all of these problems more efficiently than ever before. The time commitment is as straightforward as signing up. Immediately, actionable AI-powered strategies are at the investment manager’s fingertips. Utilizing AI expresses vision toward the future, and an understanding that AI will continue to disrupt industries. The technology, talent and cost hurdles are easily leapfrogged by adopting a point-and-click solution that is intuitive but comprised of proprietary, specific to finance, algorithms.

I’m so proud of the team at Boosted.ai on this newest expansion into simplified, efficient AI for asset management. If you want to learn more about how our actionable AI insights can help your investment management, please reach out to us at sales@boosted.ai.