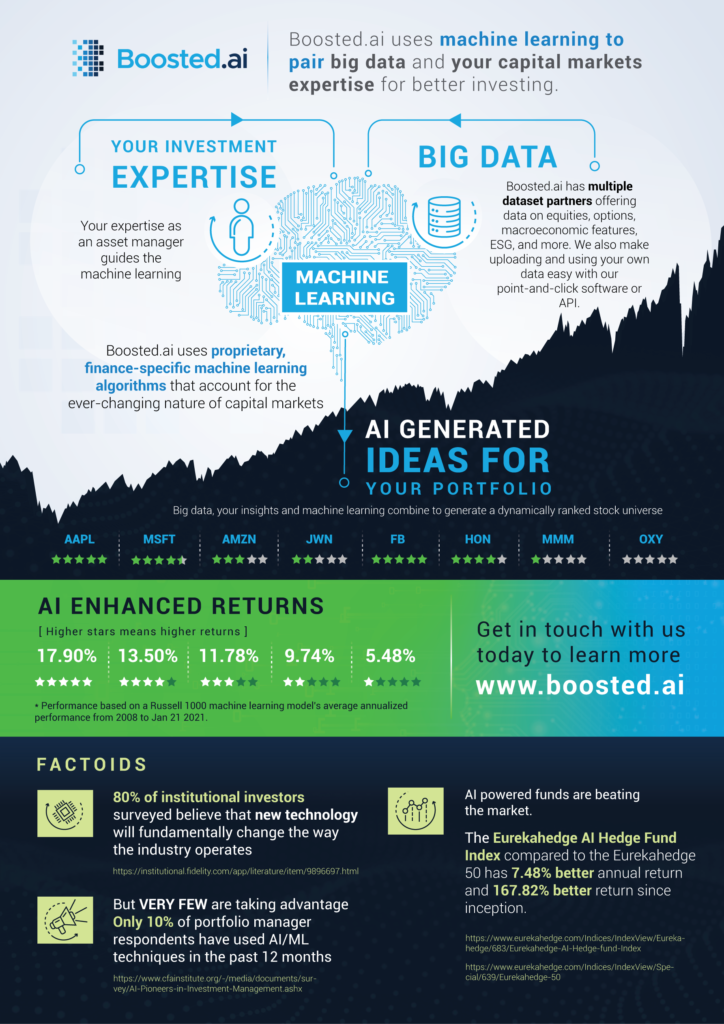

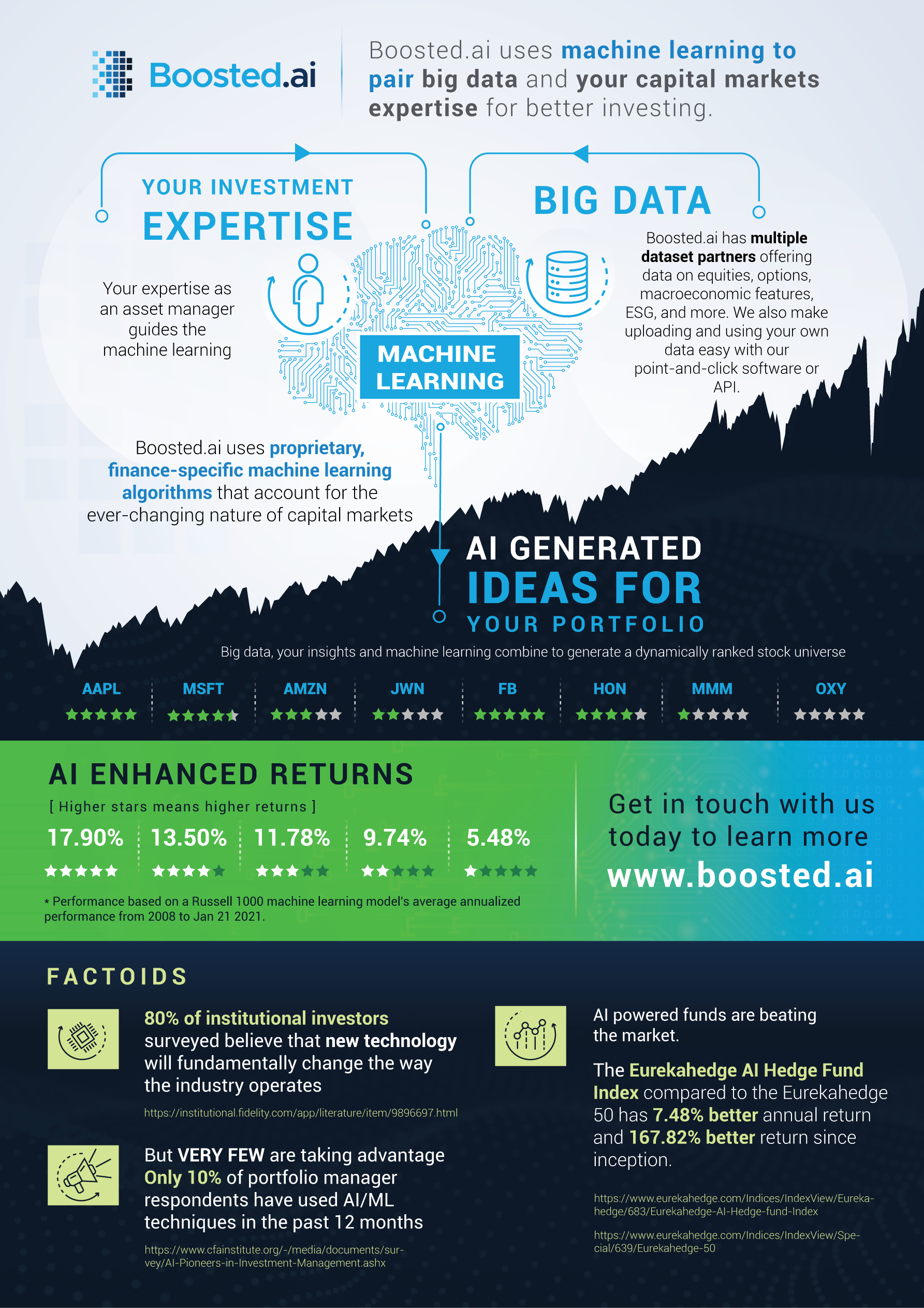

Curious about machine learning for investment management? Check out this infographic, which illustrates how Boosted.ai combines your capital markets expertise with big data, adds our proprietary, finance-specific machine learning algorithms and then generates ideas for your portfolio.

Our machine learning takes your inputs and works to create a dynamically ranked list of stocks that can surface trade ideas for your portfolio. In practice, we have seen that 5-star ranked stocks performed more than 12% better than 1-star ranked stocks in a Russell 1000 model based on average annualized performance from 2008 to January 2021.

80% of institutional investors believe that new technology will fundamentally change the way the industry operates. It already is – the Eurekahedge AI hedge fund index has a better annual return against the Eurekahedge 50. Despite this, only 10% of portfolio managers claim they’ve used artificial intelligence or machine learning techniques in the past 12 months.

Institutional investors who want to be pioneers in the AI revolution can reach out to us to learn more about how we can help them surface portfolio opportunities and implement AI today.