Investment advisors and wealth managers – like institutional investors – know that using AI can benefit their business. In fact, research by Accenture found that almost every advisor surveyed (97%) believes that AI can help grow their book of business organically by more than 20%. The problem is that half of those advisors said their firms’ AI tools and insights are too complicated to use, making it challenging to act on their digital vision. To make the most of the data-rich insights that artificial intelligence can provide, AI tools for investment advisors must be simple to use and easy to put into action.

Institutional quantitative investors were the earliest clients of our AI platform, Boosted Insights. Over the years, we enhanced our platform’s functionality to support the institutional fundamental investors that had started seeking AI and machine learning solutions for their investment process.

We have now expanded the ease and functionality of Boosted Insights to the investment advisor (IA) market – here are some ways that IAs can leverage AI to augment their process.

How can investment advisors benefit from AI?

How AI helps wealth managers have better client interactions

Attract and retain clients

Making use of data-driven AI for ideas and research is one of the best ways for advisors to differentiate their services in a crowded market.

With the “great wealth transfer” on the horizon – more than $68 trillion is expected to pass to a younger generation – it’s mission critical for investment advisors to be digitally advanced. An Accenture report suggests that younger investors are at least twice as likely as older investors to trust financial advice generated by an algorithm (cited by 96% of Generation Z investors and 79% of both Millennial and Generation Z investors, versus only 38% of Baby Boomers). What’s more, the same survey says that nearly half of respondents selected an advisor’s technology offerings as one of the most important factors to them when choosing an advisor.

Using AI to improve communication with your clients

Advisors using AI in their investment process can communicate their decisions and suggestions more effectively and confidently to their clients. However, any artificial intelligence an IA uses that isn’t fully explainable is a non-starter. Read more about explainable AI here or watch our webinar here.

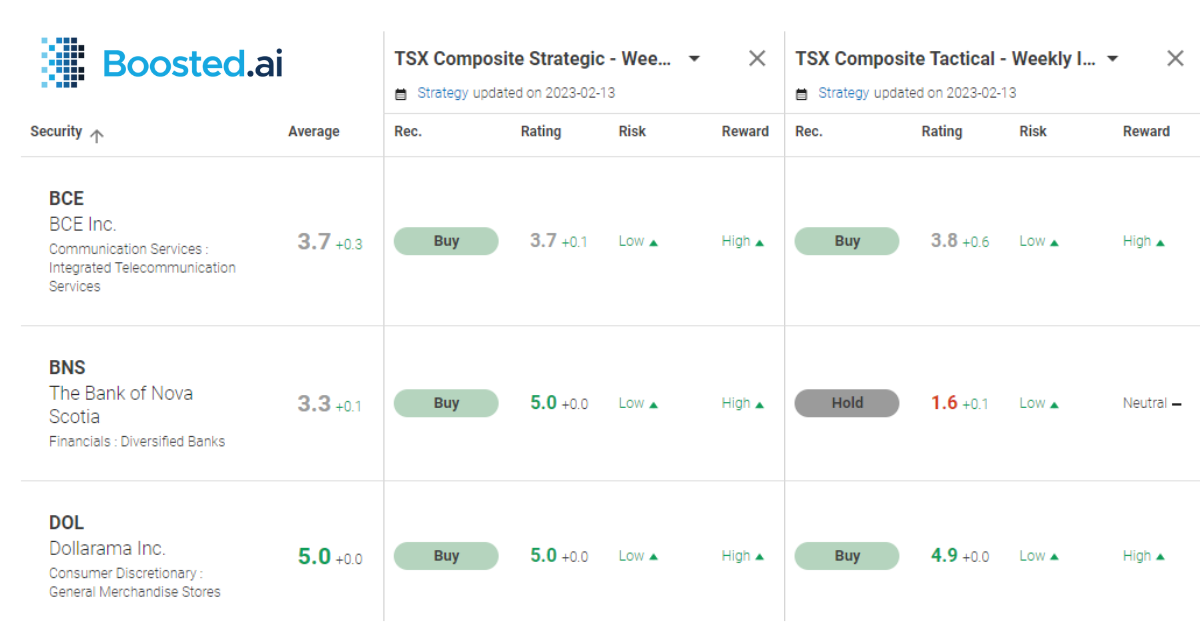

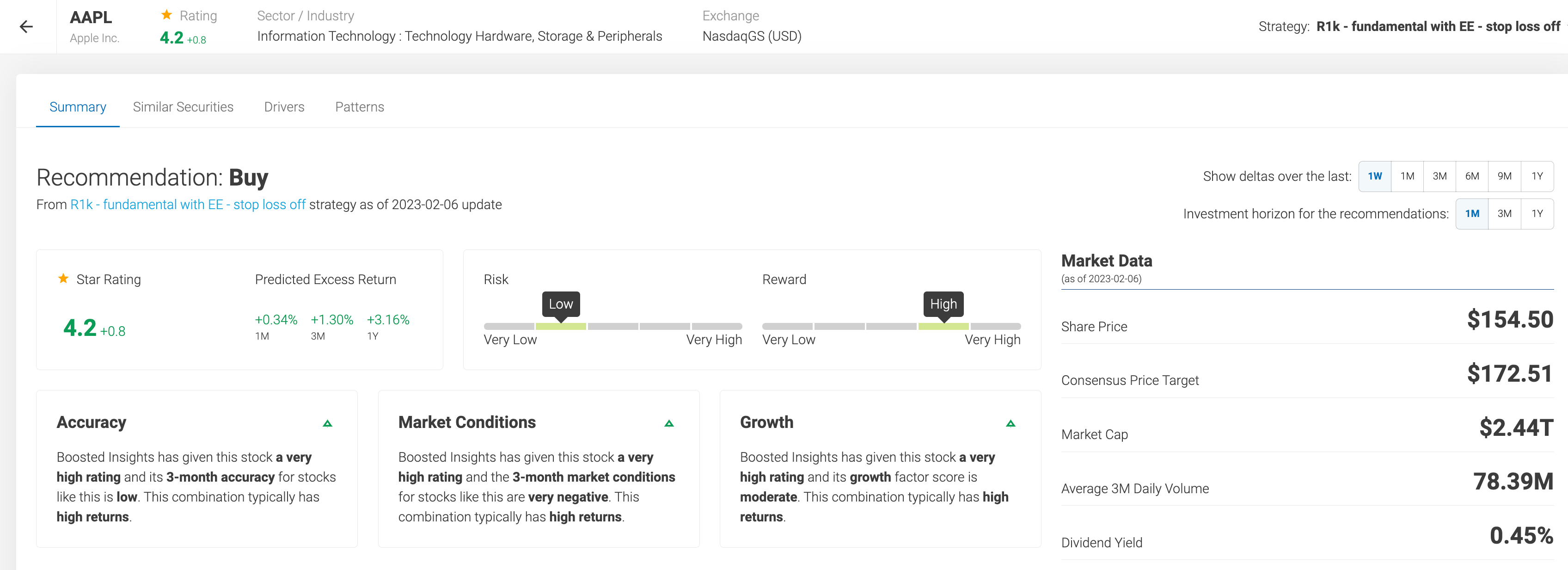

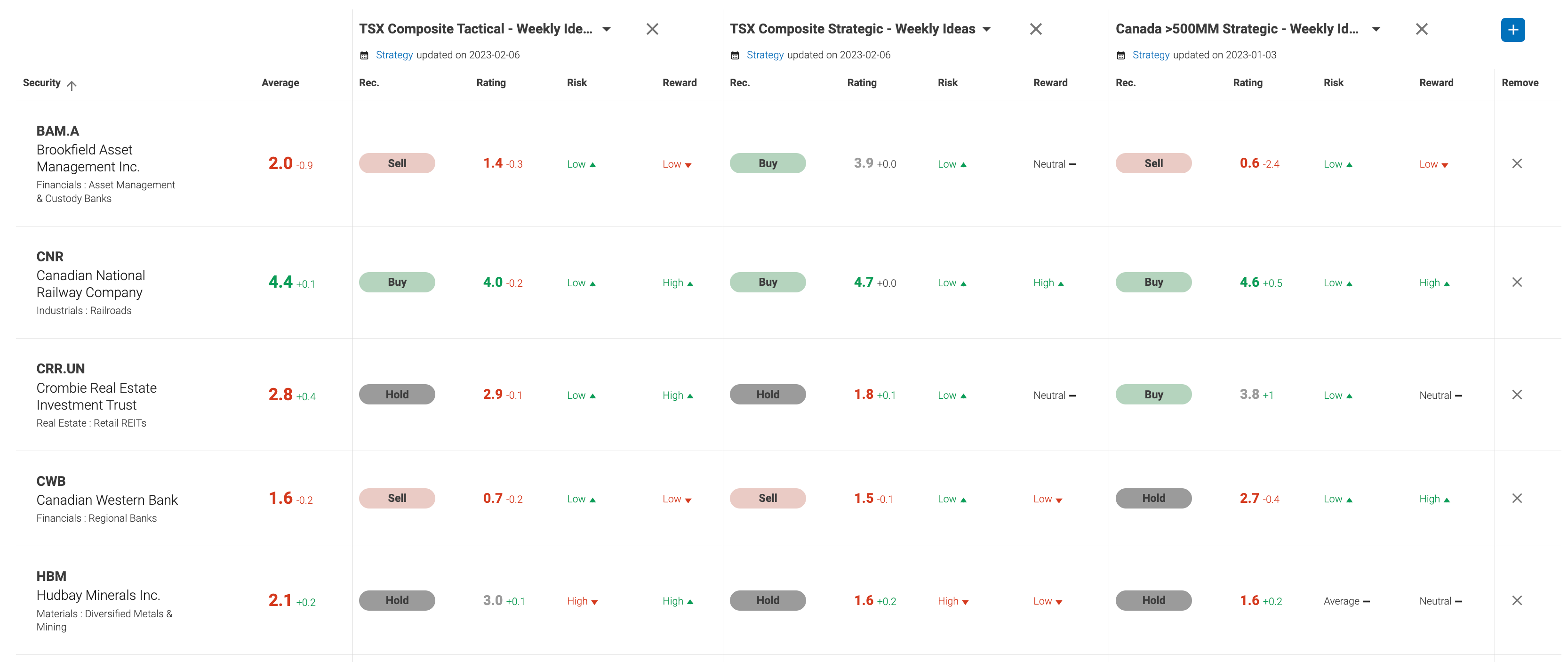

Our focus has always been on explainable outputs. In Boosted Insights, the machine’s recommendations are explained in plain text through easy to understand concepts like high risk and high reward.

Pages like stock drill down and ideas give digestible, data-driven insights you can bring to your clients.

Using AI saves investment advisors time – giving them more opportunities to be speak to their clients

At its core, artificial intelligence simply allows its users to understand vast swaths of data easily and efficiently. Look at platforms like ChatGPT – its ability to process huge amounts of information is making life easier for its users, helping study, create content, and even aiding in job searching.

Boosted.ai serves as an advisor’s personal quantitative assistant, available at any moment’s notice with an in depth report on any stock. The plain language AI insights Boosted Insights delivers allows advisors to always have up-to-date information available to share with their clients about the market and the securities their clients care about. The time and resources advisors save by having an AI research platform allows them to spend more time with their clients.

How AI helps investment advisors augment their investment processes

Generate data-driven new and unique investment ideas

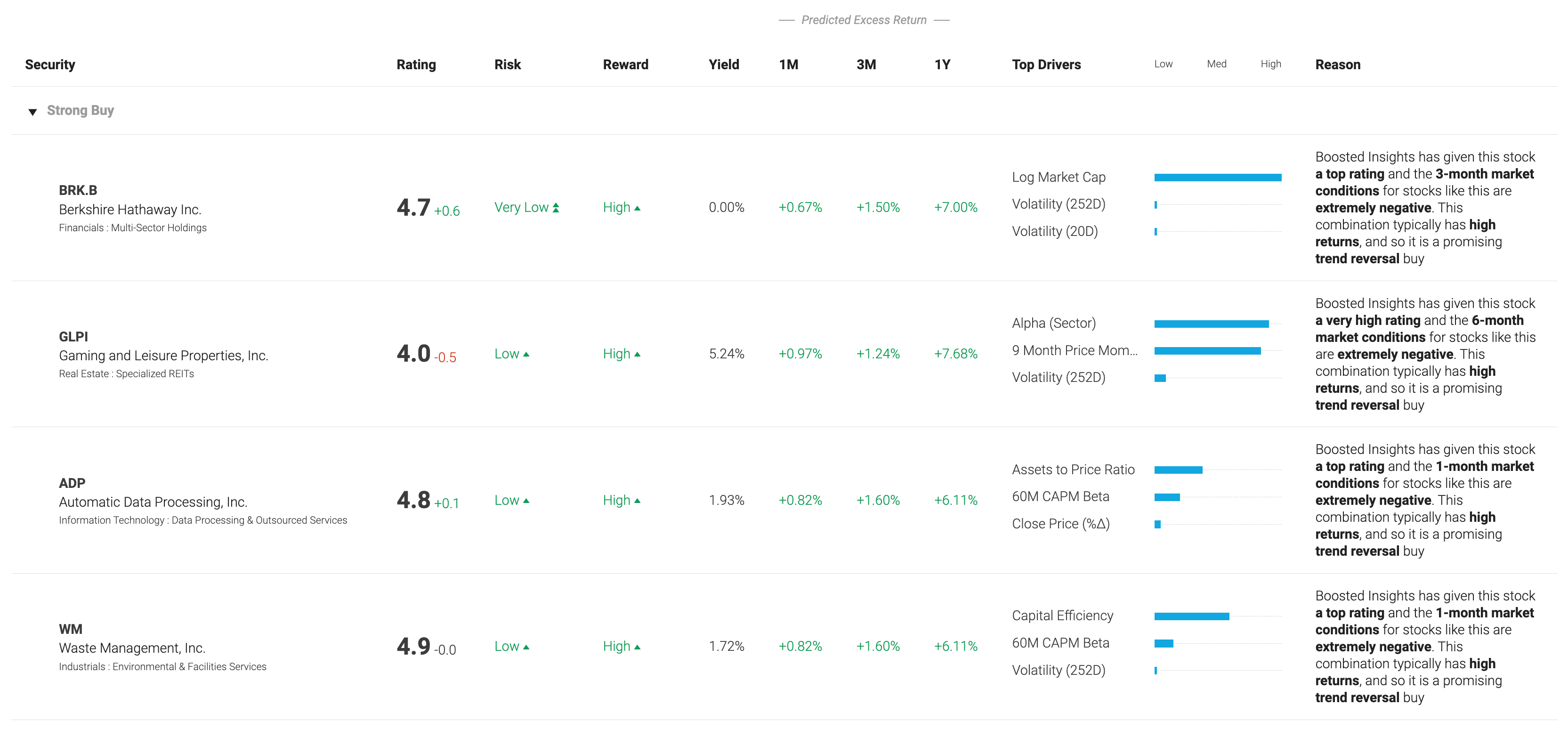

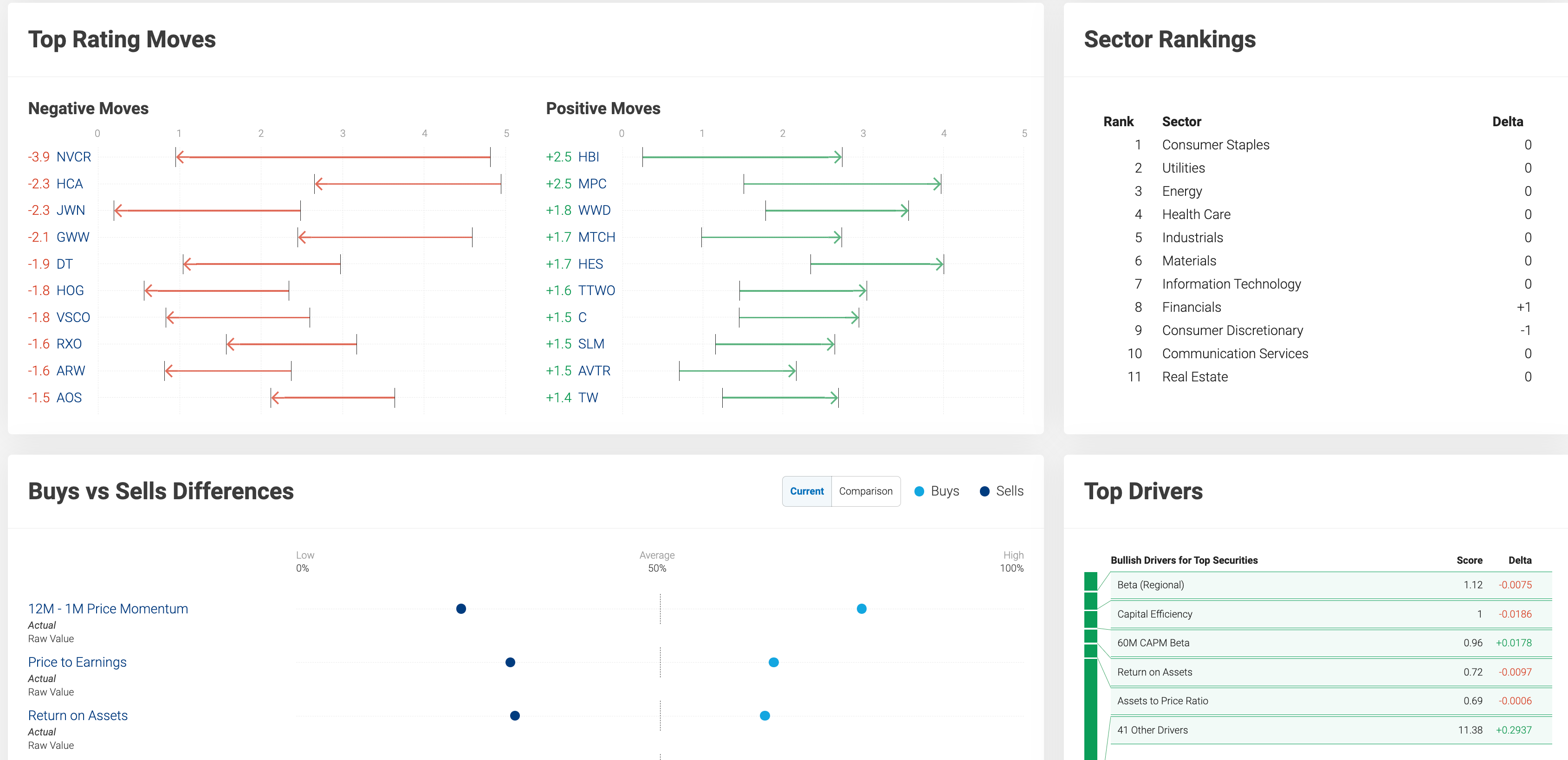

AI can provide new and unique investment ideas to a wealth manager. Our machine’s real time data delivers AI-based market drivers and trends, sparking new investment ideas for users. Investment advisors can isolate market-moving trends because Boosted Insights is constantly running and analyzing real time data. Advisors can dive deeper into these unique buy/sell ideas by investigating single-name securities through an AI lens, allowing them to analyze these securities from new perspectives.

AI adds conviction to an investment advisor’s stock selection

Boosted.ai’s real time AI insights make it easy to monitor existing and potential investments. Users can monitor all of the stocks they care about from one screen, creating comprehensive watchlists custom to their investment universe. Advisors can group the watchlists and sort by any parameter than meets their needs. Advisors can substantiate their firm’s top-of-house recommendations by cross-referencing with their virtual AI analyst.

Using AI improves investing discipline

Investing, whether it be for advisors or clients, will always remain somewhat an emotional process. In times of high volatility, advisors need to be confident in their decision making. Leaning on big data and machine learning, our AI platform can help alert advisors of when to enter and exit positions to ensure steady risk adjusted returns for clients. Advisors can then confidently explain these decisions to their clients with easy to understand machine learning outputs.

Takeaways

Advisors looking to differentiate their services and improve their investment process must consider AI solutions. The AI revolution that has taken over institutional investment is trickling down into the personal investment advisor industry, and as Deloitte pointed out in their AI report, “Late adopters are running the risk of being left behind as the industry evolves to establish a new normal”.

We believe that the future of investing combines the capital expertise of experienced professionals and the quantitative analysis of new machine learning and AI technologies.

Interested to hear more? Reach out to us here