In a recent webinar, Erik McBain, Director of Growth at Boosted.ai, shared his latest insights into the shifting investment landscape and how AI will continue to impact the institutional investment and asset management industry.

Changing Industries and the Universal Adoption of AI

As artificial intelligence evolves and becomes increasingly efficient, various industries have begun to implement machine learning practices into their business models. The way in which professionals across industries are conducting their business is changing alongside the ability to make data-driven decisions.

AI and machine learning have primarily been linked to the technology industry. However, as time passes and techniques become more advanced, we will see businesses in all sectors utilizing AI. From insurance companies using intelligent claims processing methods to law firms implementing paralegal functions powered by artificial intelligence, machine learning will become endlessly applicable.

Factors of Expansion

There are several reasons as to why right now is the tipping point for AI to take over as the leading contributor to company efficiency and profitability, while generally improving overall understanding of information within any business. Over the years, computing power and algorithmic power have improved tremendously. Additionally, the level of data available to input into computers and algorithms sits at an all-time high.

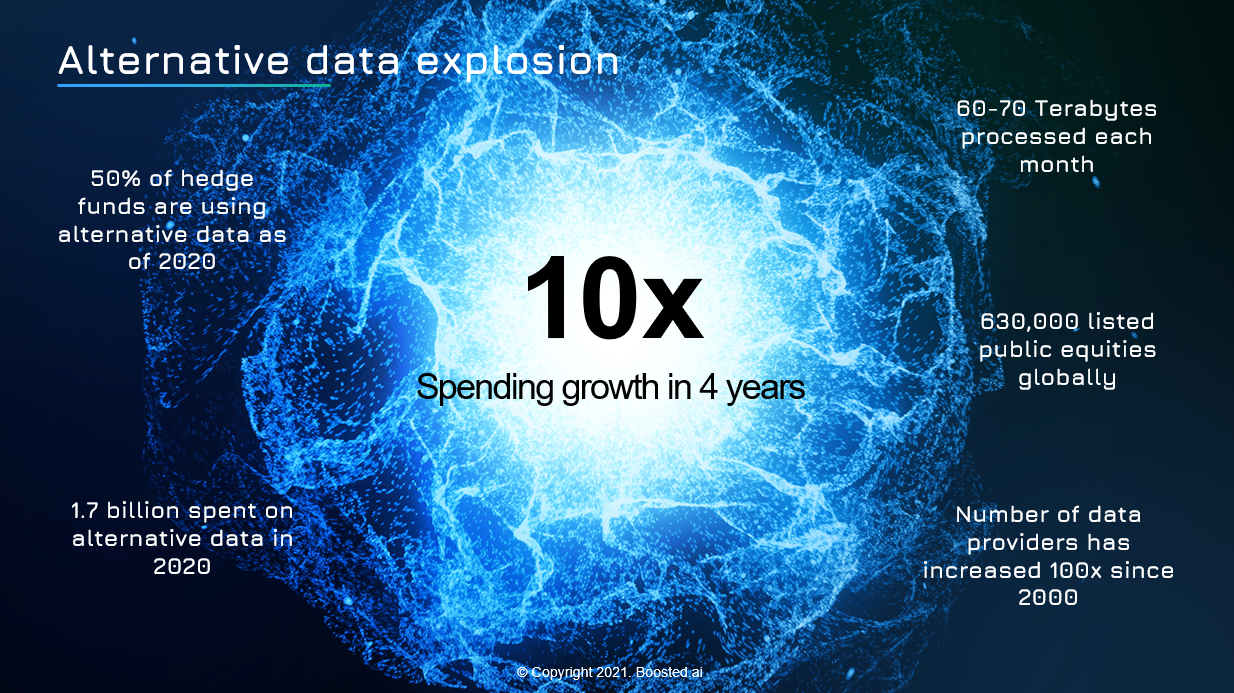

In the last four years alone, alternative data spending has grown tenfold. As of 2020, $1.7 billion has been spent on alternative data.

Boosted.ai is uniquely positioned to help firms take advantage of this growth: 50% of hedge funds are using alternative data as of 2020, and the percentage is expected to increase as firms recognize the value of big data and AI.

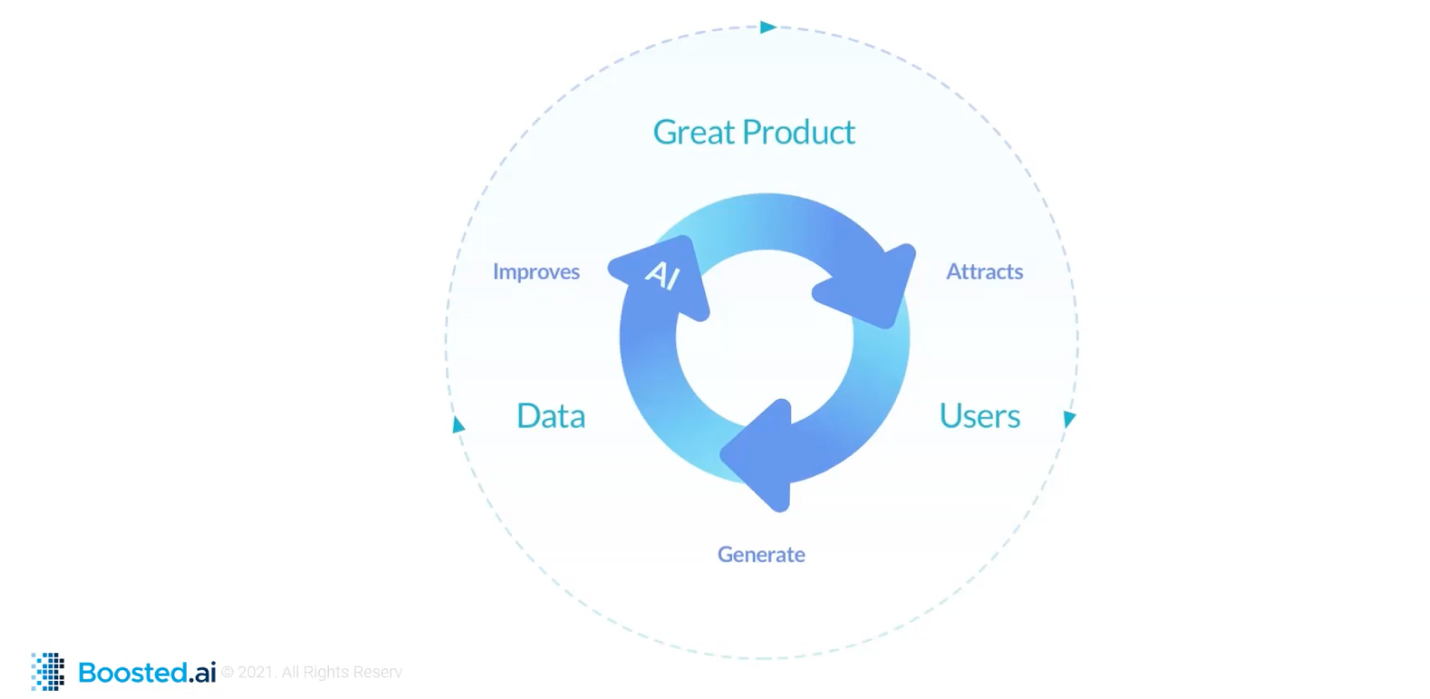

There is a virtuous cycle within AI where industry leaders can compound their growth over competitors due to having a greater supply of data. We have been collecting data for as long as anyone in the quant investing space, giving us a head start on providing world-class algorithms.

Historically, advanced quantitative strategies and tools have sat in the exclusive domain of a small section of the financial industry – out of reach for more traditional investors. Now, there is a democratization of access to these sophisticated technologies and strategies. At Boosted.ai, we sit in the middle of this revolution and offer our solutions even to low-code/no-code investment firms.

Transforming the Landscape

Boosted.ai is accessible to all types of investment funds because of the explainability of the platform. You do not need to understand code to understand the functionality of our machine learning platform.

With 87% of family offices believing AI will be the biggest force in global business and 80% of institutional investors believing new tech will change how the industry operates, it’s not a far-fetched idea to think Boosted.ai will have an impact on investors everywhere. Only 10% of portfolio managers used artificial intelligence or machine learning in the past year, which leaves thousands of companies that have yet to experience the benefits artificial intelligence can bring to their processes.

The 4th Industrial Revolution

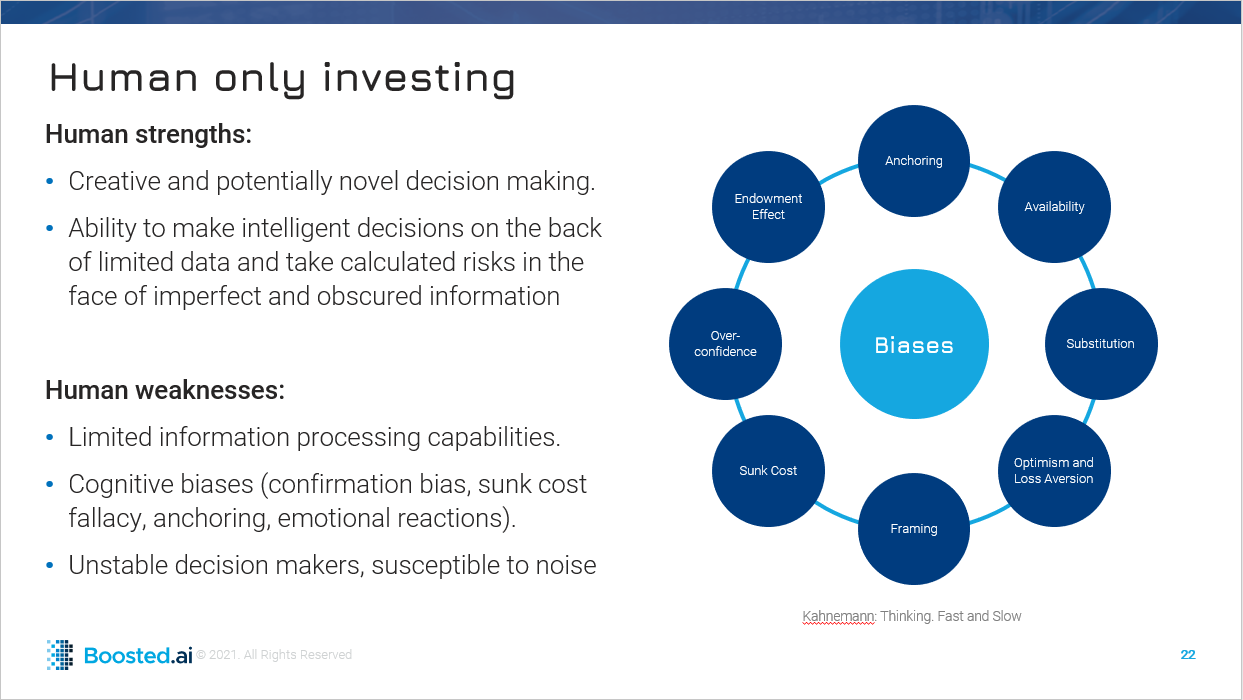

The goal of artificial intelligence in investing is not to replace portfolio managers. Intuition is best left to humans – but machines are quickly catching up. Over time, those who do not utilize the efficiency of AI and machine learning will eventually become obsolete in the industry.

The balance between the human and machine is imperative to the success of AI-driven investing, which is why we’re focused on guiding portfolio managers to understand what their quantitative strategies are doing and why.

Boosted.ai’s Advantage

Quantamental investing is partially defined as the search for and identification of unknown patterns. These patterns are difficult, if not impossible, for a human manager to pinpoint. That’s why 35 institutional asset managers with over $750B in collective assets under management use our platform.

With Boosted.ai, you still select your stock universe and input certain factors, which enable the machine to deliver alpha. At the end of the day, it is up to human portfolio managers to analyze their own stock picks – this time, using explanation from Boosted Insights. To watch the full webinar, click here. To learn more, book a demo with us today.