Investment management is facing an ever increasing set of pressures, from data overload, to fee compression, to paying attention to every piece of information so they ensure they never miss a thing. Artificial intelligence is helping asset managers combat these problems, but when we talk to clients and prospective clients, we have heard that even with buy-in from their teams on the transformative nature of AI, it can be difficult for teams to understand how to harness its potential effectively. We did a webinar on the subject, but we also created this guide to outline the essential steps to crafting an AI strategy that aligns with your firm’s goals and resources.

Asset management’s big problem

Investment managers face several critical challenges. They must conduct thorough analyses despite limited resources. The volume of data continues to grow exponentially, making it harder to process and analyze effectively. What was once a nice-to-have, like, say, credit card data, is now a must for managers to have any hope of competing with their peers. Finally, persistent fee compression pressures firms to deliver more and more value at lower and lower costs.

The benefits investment managers are seeing with AI

AI offers significant advantages in investment management by enhancing productivity, improving decision-making through data and having an “always on” approach that helps managers ensure they are always on top of everything that might affect their portfolios. This added productivity slashes the time needed for idea generation and research, and allows managers to focus on their most high-value tasks. Additionally, clients are increasingly demanding that their asset managers make use of cutting-edge technology – 95% of executives surveyed in a recent Accenture study believe that an asset manager’s technology, data, and digital capabilities will be differentiators in 2025.

Use cases and workflows of AI in investment management

AI is unlocking value in several key areas.

Direct trading with AI

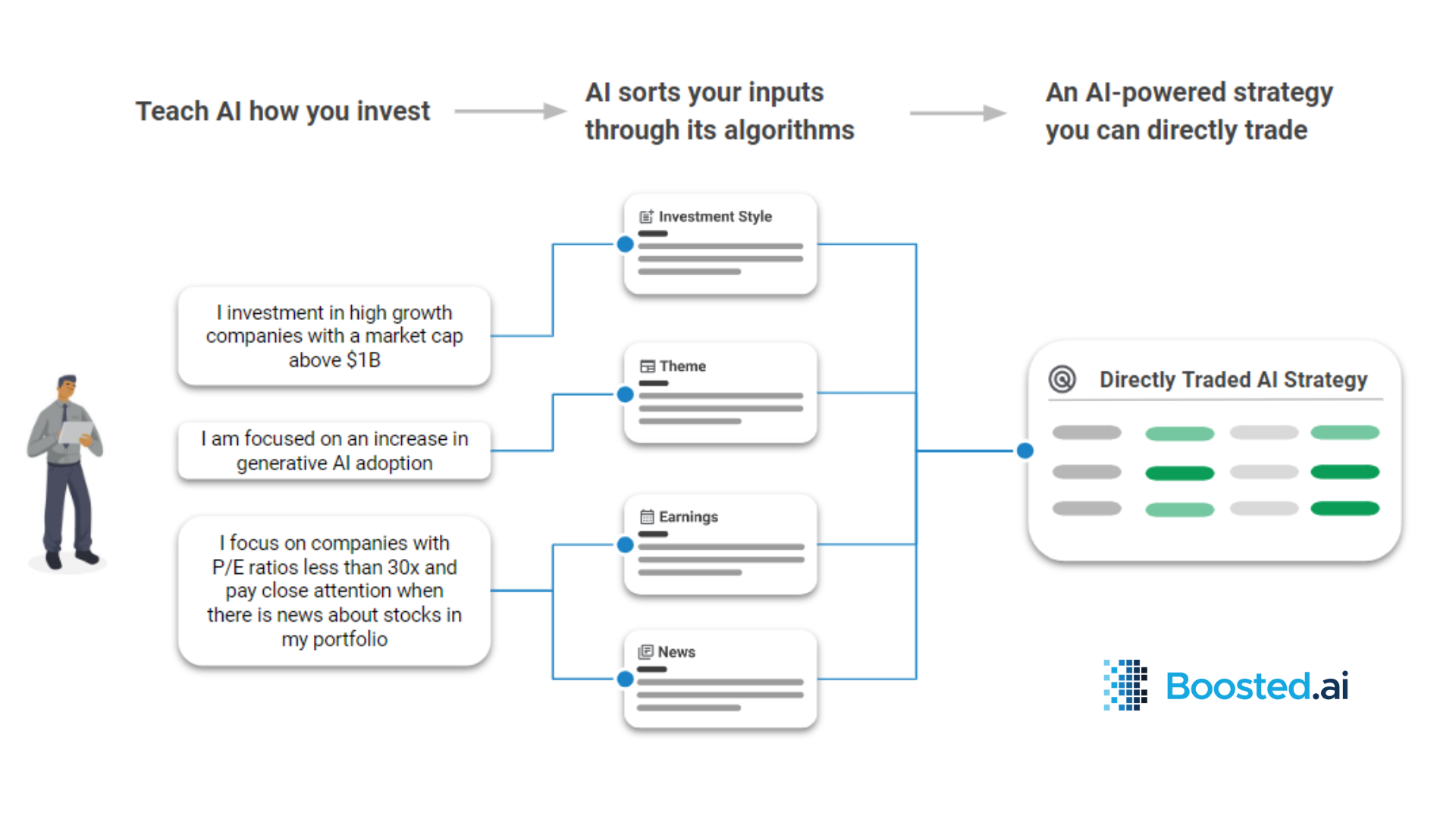

In direct trading strategies, AI delivers trade ideas that match a user’s investment philosophy, saving time and ensuring alignment with their strategy. In a direct trading workflow, you start by teaching AI your investment style. AI processes your inputs to generate suitable trade ideas, which you can then execute based on AI-generated strategies.

Idea generation with AI

In idea generation, AI uses big data to identify investment opportunities tailored to the investor’s style, making the research process more efficient. For idea generation, you define your investment criteria and let AI filter through vast data to highlight relevant opportunities. You then focus on the most promising ideas identified by AI

Investment research with AI

AI is also expediting research by reading and summarizing news, financial reports, and analyst notes, drastically reducing the time spent on these tasks. An AI-empowered research workflow involves setting your research parameters, allowing AI to review and summarize essential information from various sources, and using AI-generated insights to make quicker, more informed decisions

Client communication with AI

AI is enhancing client communications by enabling data-driven interactions and providing precise and timely answers to client queries. Improved client communications involve AI assessing portfolio impacts based on the latest data, summarizing relevant articles and reports, and providing data-driven responses to client inquiries.

Buy, build, or do nothing?

For most investors, the question isn’t “is AI powerful?” – it’s “how can we adopt or implement such a complex solution effectively?”. When considering AI adoption, asset managers face three options: buying an off-the-shelf AI solution, building their own AI, or doing nothing. All three share positives and negatives and which option the asset manager chooses will depend on their specific needs, but we do feel that buying will have the best results for the widest group of users.

Buying is generally cost-effective and quick to implement, with consistent updates, though the downside, depending on the solution chosen, is that the user may have limited customization options. Building an in-house AI is of course tailored to the firm’s specific needs but requires substantial investment and resources, with no guarantee of success and a significant time commitment. Choosing to do nothing is obviously both cost-effective and easy, but delaying AI adoption could leave firms at a competitive disadvantage – Deloitte research shows that late adopters run the risk of being left behind as the industry establishes a new normal.

What investment managers should look for in an AI solution

Implementing AI in finance is complex, so managers should consider several factors. First, the solution must offer a genuine AI model rather than a repackaged solution. The AI should be tailored for financial applications, with point-in-time data and clean datasets. The investor should have clear expectations of what the AI can and cannot do, and verify the solution’s data security policies. Naturally, it should cover the universe of stocks the user cares about and have robust policies around data hygiene. Finally, more holistic AI solutions – ones where multiple applications can be used (i.e. looking at micro, macro and portfolio construction, using generative AI to create portfolio commentary, etc.) should be prioritized over ones with specific and narrow use cases. We feel like an easy-to-learn AI is also best, given the time pressures on the typical manager, but one that hides complexity for users that really want to “get under the hood” to play around with the capabilities of the tool.

Final thoughts

AI enables investment managers to achieve greater efficiency and make more data-driven decisions. The key use cases include direct trading, idea generation, research, and client communications. For most firms, purchasing an AI solution is the best route, provided it is tailored for finance and meets all your needs. By embracing AI, investment managers can stay ahead of the curve, delivering superior value to clients while optimizing their own operations.

Interested to hear more? Reach out to us here