In asset management, the ability to gain insights from breaking news ahead of your competition is indispensable. By leveraging AI, which is capable of analyzing datasets comprising tens of thousands of news sources, investment managers can navigate the complexities of big data, and can swiftly identify impactful trends and critical information as they happen. This deeper understanding not only saves valuable time but also positions asset managers at the forefront of decision-making, transforming information into actionable intelligence and ultimately enhancing their investment processes in the dynamic world of asset management.

Here, we’ll walk through a real world example of how leveraging AI can surface unique ideas earlier than traditional news sources. Using Boosted Insights – our AI platform for investment management – users found news about Apple Inc. (AAPL) months before it was reported in larger news sources.

Boosted Insights and Market Trends

Boosted Insights is our AI platform purpose-built for capital markets. Combining macro (global news), micro (stock picking) and portfolio construction into one tool, it allows investment managers to supercharge their productivity by saving time, enhancing their portfolio metrics and enabling them to make better, data-driven decisions. Our Market Trends feature, powered by generative AI and large language model technology, allows users to effortlessly navigate through vast amounts of data, including news articles and earnings releases, to identify the latest, most impactful market trends. Users can conduct research on rising interest rates, inflation concerns, or the potential impact of a recession in minutes, not hours or days.

AAPL’s operational challenges

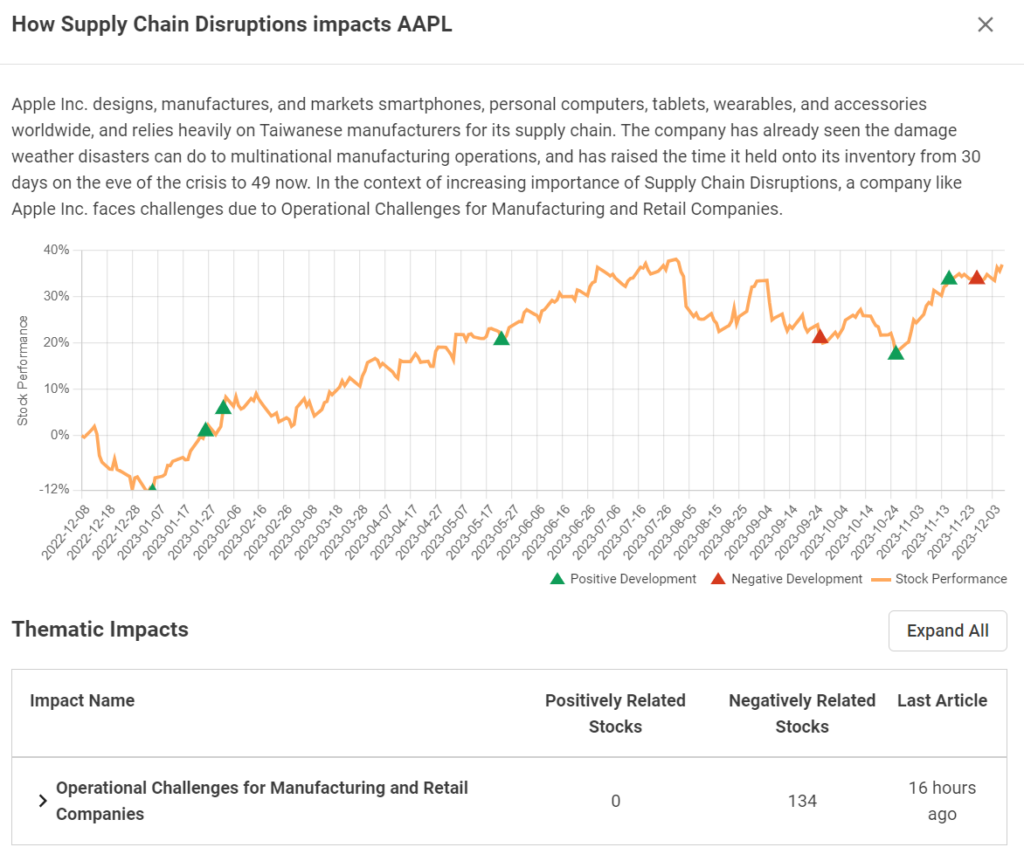

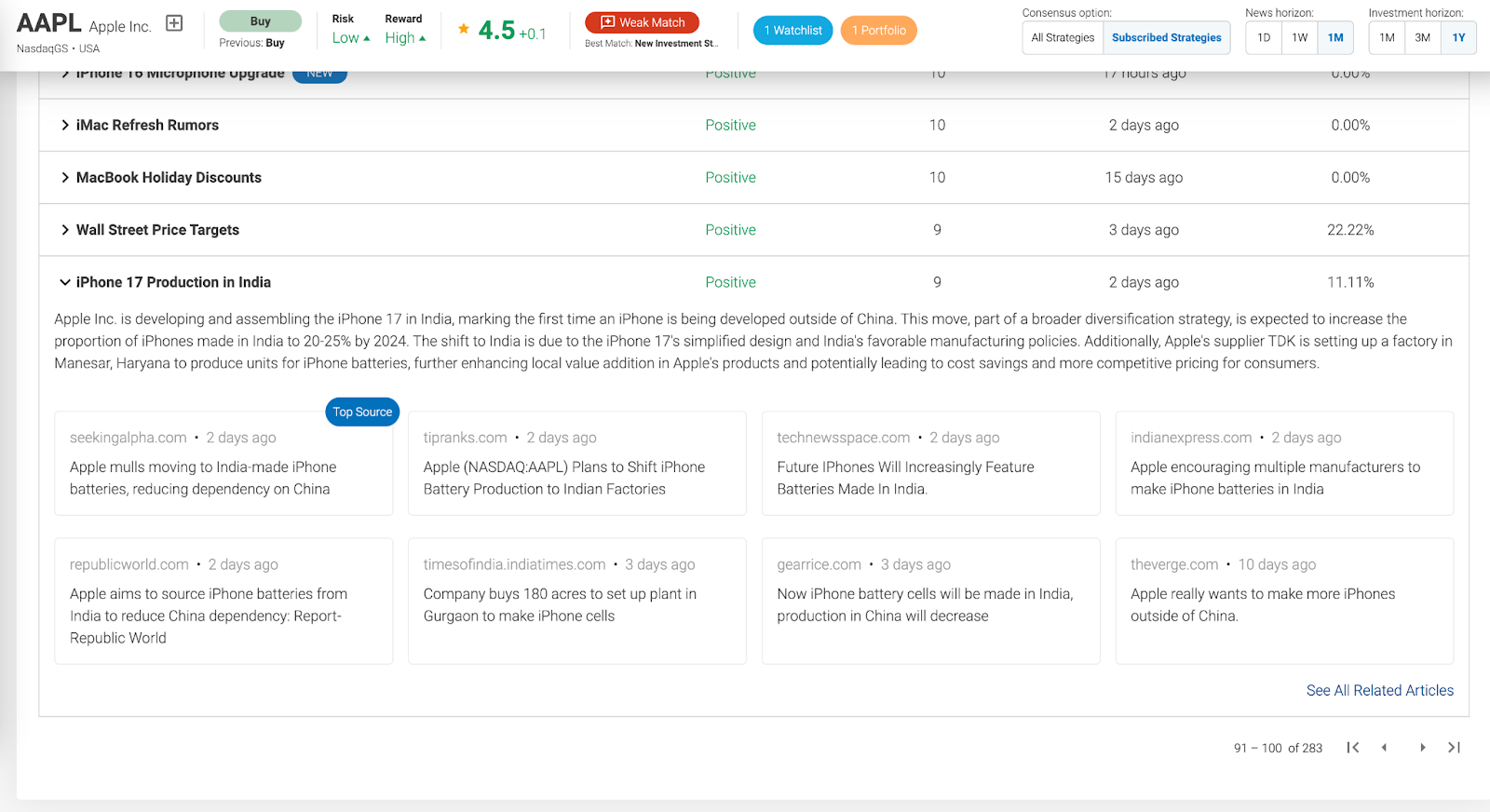

Despite AAPL’s impressive year-to-date performance, operational challenges, specifically manufacturing delays, have affected the company. In February 2023, AAPL reported a drop in iPhone sales and its first quarterly revenue decline in four years due to disruptions in the Chinese supply chain. Recognizing macro themes like “Supply Chain Disruptions” is critical for investors seeking a comprehensive understanding of the factors influencing a stock. Boosted.ai clients gain a strategic advantage by utilizing Market Trends to identify major themes affecting the S&P 500. For AAPL, our Market Trends feature highlighted the theme “Supply Chain Disruptions,” showing a negative impact on the stock. The critical importance of AAPL’s supply chain makes it essential for investors to be aware of any actions taken to improve manufacturing capacity.

Gaining first mover advantage through Boosted Insights

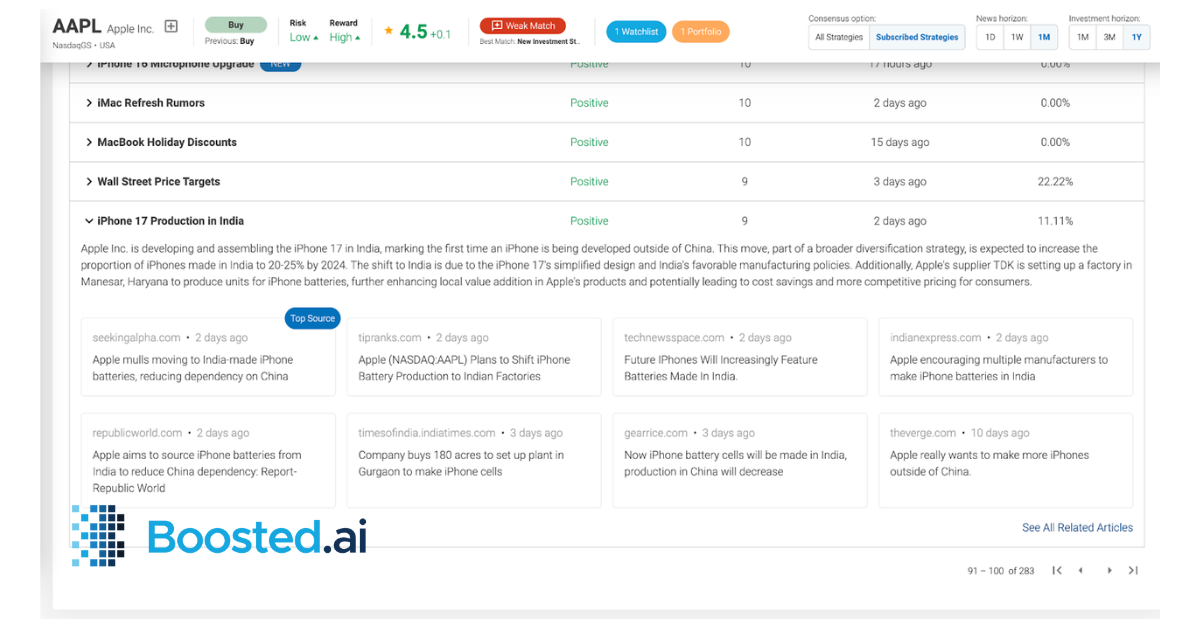

On October 4th 2023, our proprietary Large Language Model (LLM) technology uncovered an important development for AAPL in a positive direction: the company’s diversification and expansion of production in India. Boosted.ai’s LLM technology detected this crucial information months before major news sources – the Wall Street Journal reported on the same development in December – offering users a first mover advantage. While most investors learned about AAPL’s strategic move through mainstream financial news within the last few days, Boosted.ai’s clients were already ahead of the curve.

Takeaways

Market Trends is not just a feature; it’s a game-changer for investment managers. The AAPL case study exemplifies how Boosted Insights equips investors with the tools to identify, analyze, and act on market trends before they become widely known. In a world where timing is everything, Market Trends ensures that Boosted.ai clients are not just keeping up with the market – they’re staying one step ahead. If you want to learn more about how large language model technology can help you – book a demo with us here.