How Boosted.ai automates and augments your portfolios

Data-driven AI to enhance your portfolio construction

Data-driven AI to enhance your portfolio construction

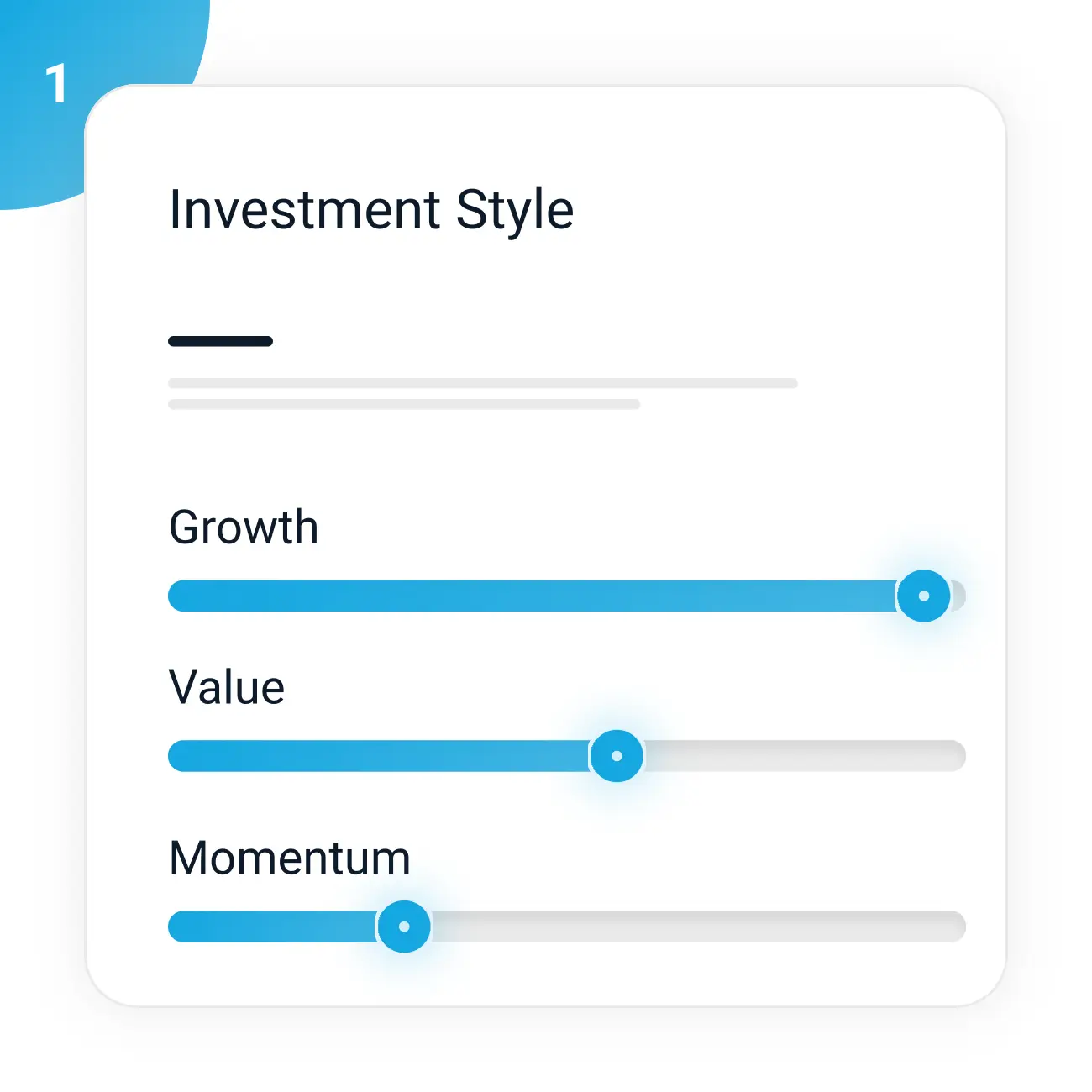

Tell Boosted.ai how you like to invest

Tell us how the portfolio should be structured

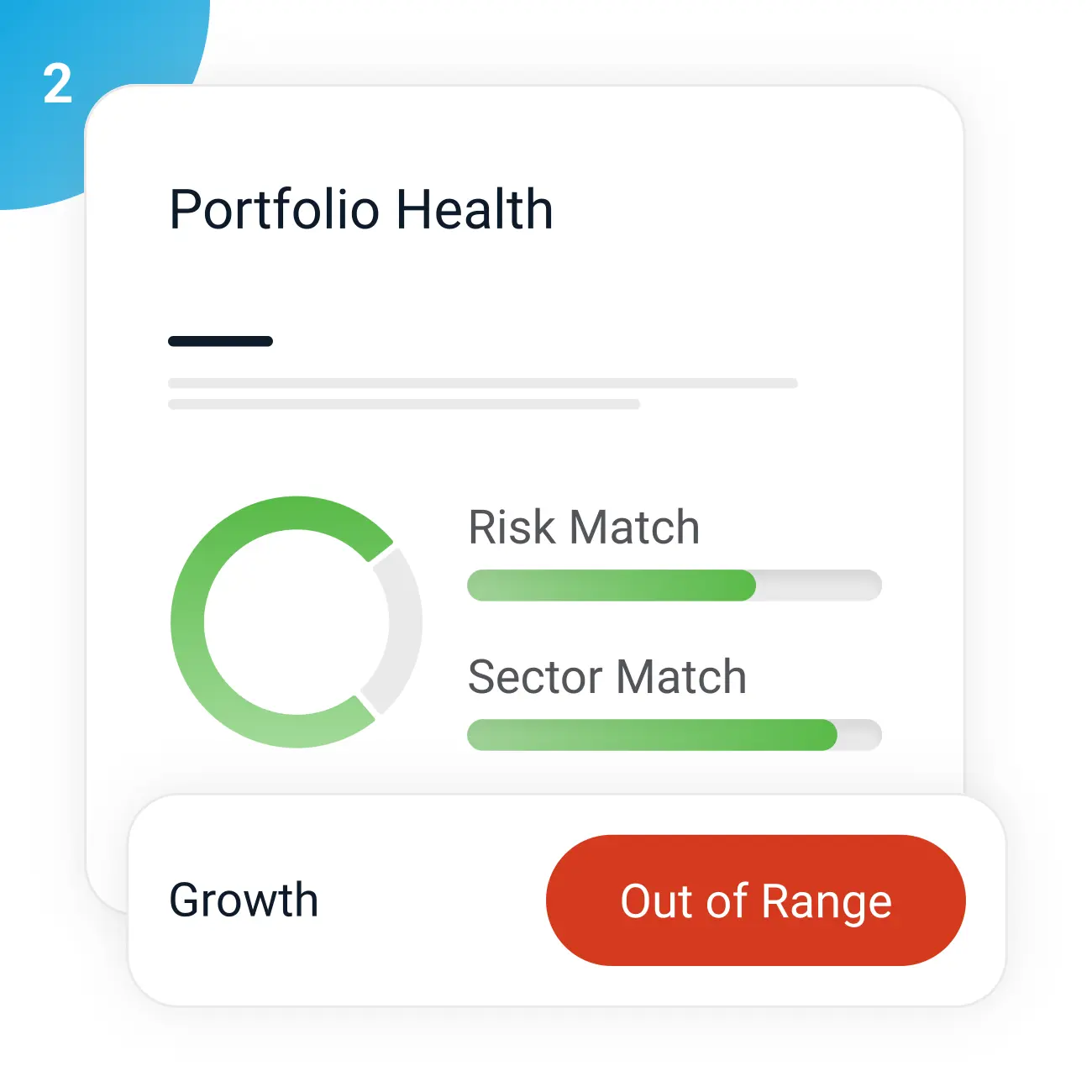

Monitor your portfolio with data-rich insights

Stay on top of any shifts in your portfolio. Understand how factor and sector risks can impact your portfolio health score.

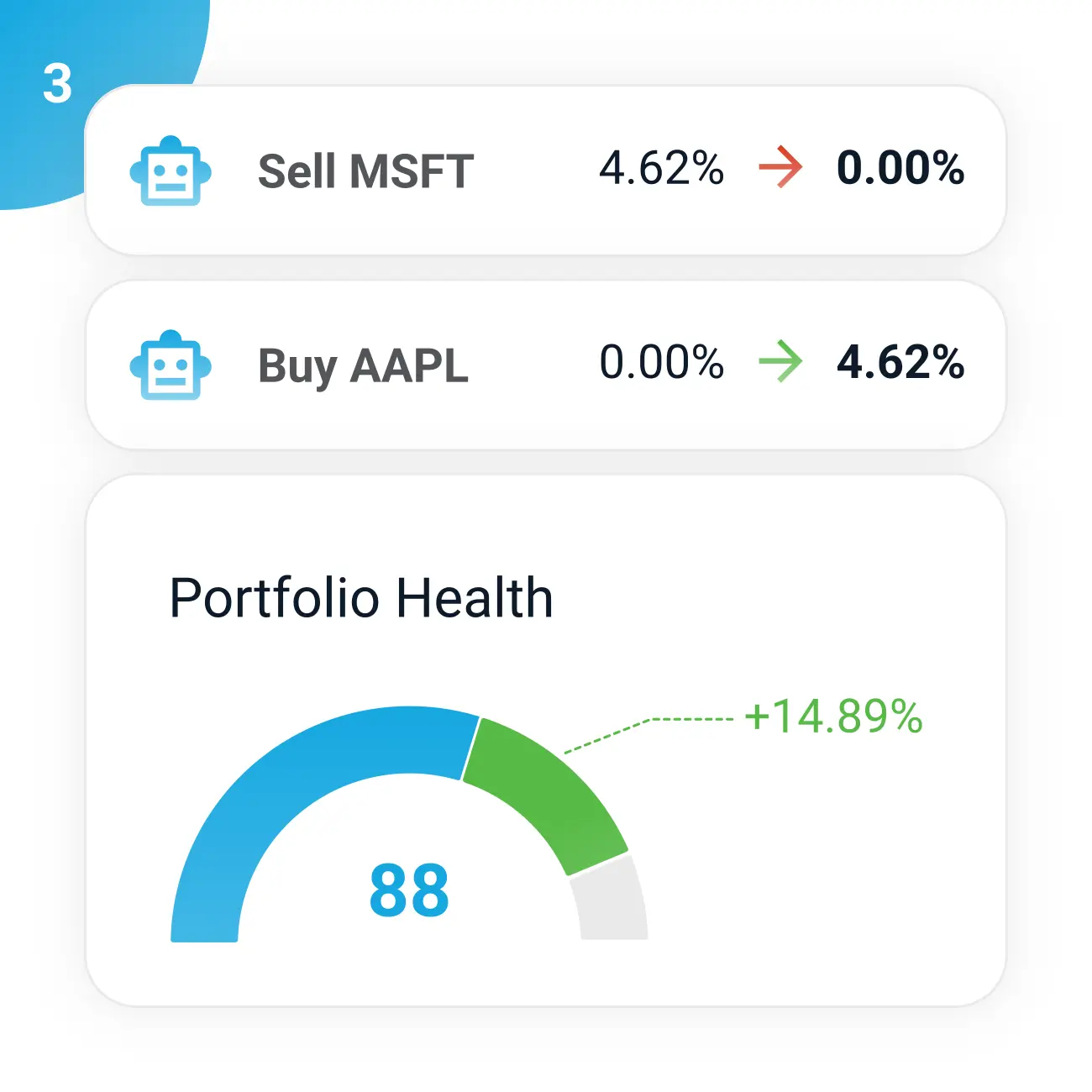

AI suggestions keep your portfolio in perfect balance

Get actionable trade suggestions to improve your portfolio health score.

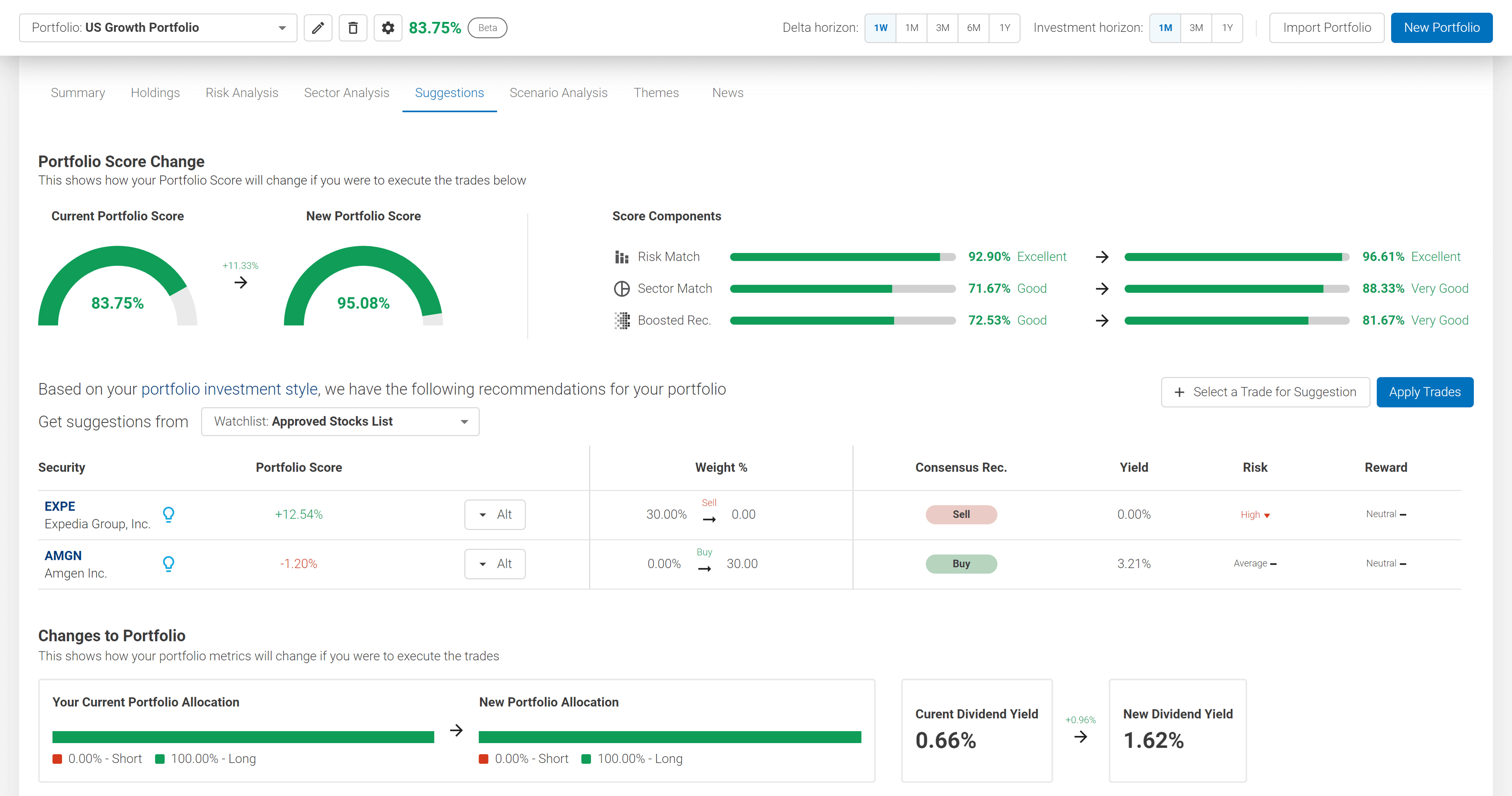

Improve portfolio metrics with Boosted.ai

Buy/sell recommendations that are tailored to you and your investment style

Dynamic suggestions control your risk

Boosted.ai monitors when your watchlists and portfolios move outside of your investment style and suggests trades to get your book back on track.

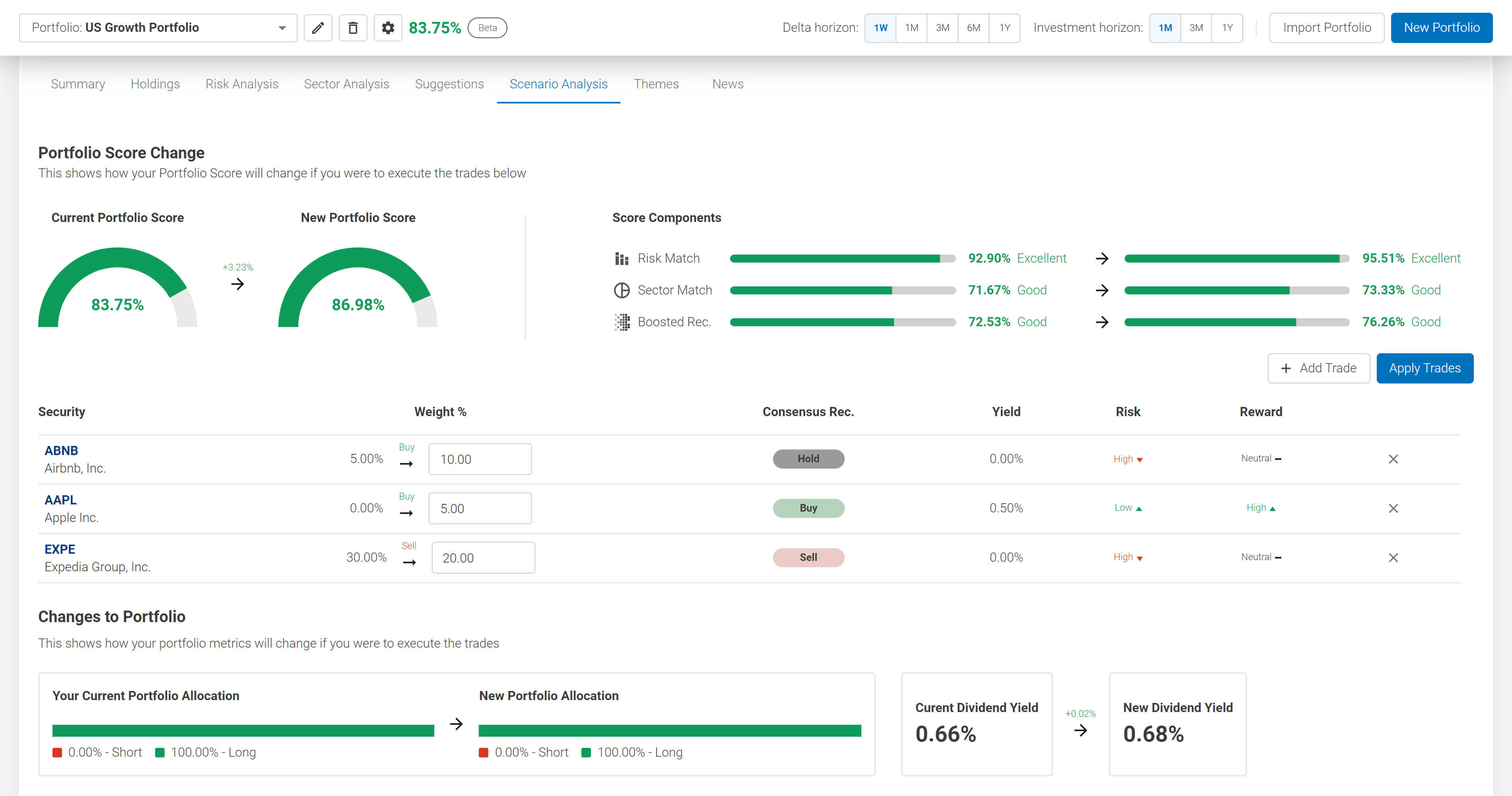

Trade hypothesis laboratory

Test trades to see their effects on your portfolio’s composition and risk profile. Risk analysis across multiple metrics shows you exactly where your risk and return is coming from.

Scenario analysis

See what would happen under different scenarios. Calculate your new allocation, dividend yield and risk factor exposures in seconds through data-driven analytics.

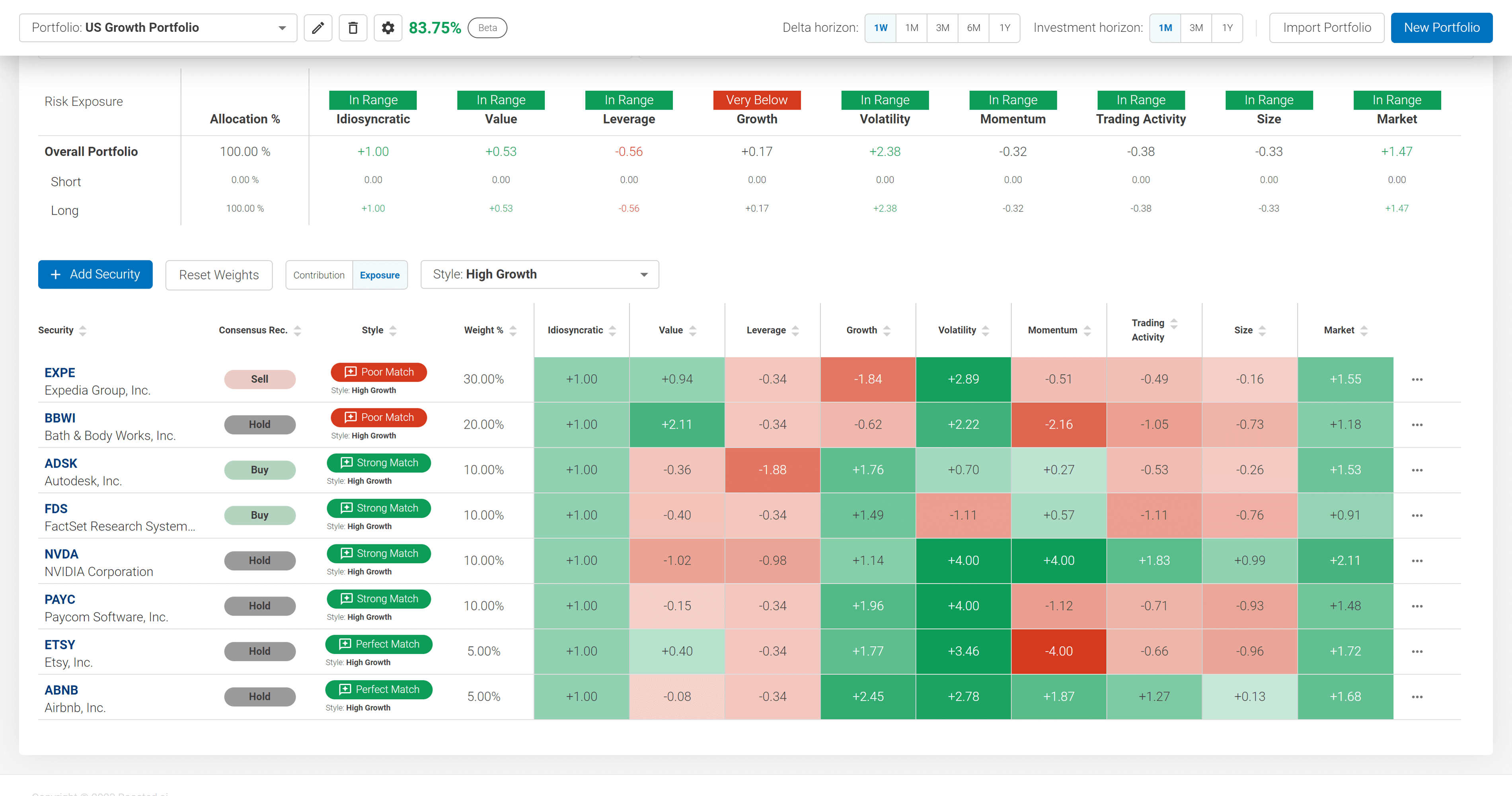

Risk analysis across multiple metrics shows you exactly where your risk and return is coming from

Set your metrics

Set your investment style and let Boosted.ai ensure you’re always within your risk parameters.

Investment style matching

A highlight of how every stock in your universe matches your investment style. Know when your portfolio is a perfect match to your mandate and when you need to adjust your stock weightings.

Risk exposure alerts

See when your portfolio is outside of acceptable risk ranges across a variety of factors, all based on your personal investment style. Our exposure view shows how much every stock contributes to factors like momentum, volatility, value, leverage and growth.

A bird’s eye view of your portfolio’s risk exposure and sector allocations

Portfolio health score

Your portfolio is scored on how it matches factor risks and sector risks and highlights the portfolio’s performance for the week against your benchmark.

Portfolio beta by factor

Understand every factor that makes up your portfolio exposure at a glance. With investment style matching, quickly see where your factors are in acceptable ranges of risk.

Sector impact

Each potential trade outlines if you are getting nearer or further away from your desired sector exposures.