GME’s Rise

It’s no secret trends come in waves. Right now, the 90’s are back in a big way. Fresh Prince of Bel-Air, Saved by the Bell and Sex and the City have all gotten reboots, kids are dressing like they’re en route to a Counting Crows concert, and GameStop (GME) – that place actual 90’s kids hung out in at the mall, back when the best cell phone game was snake on a Nokia brick, is the hottest stock this side of Tesla (TSLA), Apple (AAPL) and Amazon (AMZN).

What’s going on? GME has been an incredibly shorted stock. 100% of the float had been borrowed by short sellers, as of the end of last year, according to Barron’s. The consensus, prior to the events of January 26, 2021, seemed to agree that GameStop’s business model is dying as consumers move to making purchases online. Famous hedge fund legends like Steve Cohen and Dan Sundheim, bet big on the stock tumbling. As of January 28, 2021 – Fortune reported that Cohen’s Point 72 was down 10 to 15% this month and Sundheim’s D1 Capital Partners was down about 20%. All those hedge fund shorts seemed to rile up the retail investing community on a sub-Reddit called Wall Street Bets. The crowd at r/wallstreetbets created a short squeeze for the stock, buying it up until trading was halted – when it was halted at $405.06 it was up 109.23% on the day. GME is up 1639.79% year to date and 8311.2% since this time last year. Cohen, for his part, seemed to have a sense of humour about the whole thing, tweeting “Rough crowd on Twitter tonight. Hey stock jockeys keep bringing it”.

GME & Machine Learning

People will cluck their tongues one way or another (“retail investors are in over their heads!”, “hedge funds need to be stopped!”, “options trading is too risky!”), but our interest in GME is in how machine learning may have helped any asset managers along the way. Unlike the crew at r/wallstreetbets, whose tagline is “like 4Chan found a Bloomberg Terminal”, most investment managers seek to reduce risk. Since artificial intelligence and machine learning are predictive, we looked at our sample models to see how they stacked up against this surprising turn of events. The way Boosted.ai thinks about factor risk is a little bit different than traditional techniques. What we do is use machine learning to determine risk factors in the market. These risk factors are (currently) unnamed, but they do an excellent job of defining some of the “known” unknowns in the marketplace. In essence, what the machine is able to do is find baskets of stocks that are trading together once we strip out other risk factors. We go into more detail in our blog post about how quants may have used alternative ML techniques to navigate the quant shock. The benefit of this approach is that it highlights the biggest risks in the market today – and allows the machine to neutralize them during portfolio construction. So the billion dollar question is – did it work for GME and some of the other names that have caused issues in recent weeks?

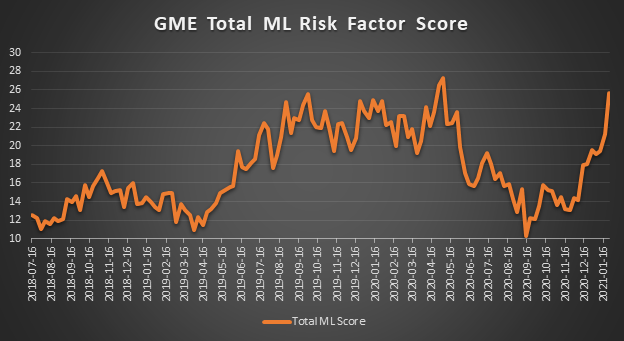

The above chart shows the total risk factor score for GME over the past few years – where a score of 20 is in the top 5% of risky stocks (in this case in the Russell 2K), and 30 would be the top 1%. It shows that the machine thought GME’s risk profile bottomed in September and has rocketed higher since. It hit the “very high risk” threshold around January 11th, just before the first sets of big moves, with the stock closing the day at $19.94. It doesn’t take a machine to see (although it will, and does) that the risk is stratospheric today.

Takeaways

Why does this matter? We talked earlier about buckets of stocks being created. If we inspect these buckets we can see if there are groupings of stocks that maybe share common characteristics. And in the Machine 8 bucket on January 11th, there were a handful of names with extreme exposure to that risk factor. Specifically: GME, AMC, VXRT, AXDX, CVM, and UNFI all had large exposures to this basket. If those names sound familiar it’s because they are all on the list of the top 20 performers since January 11th on the recent short squeezes. In fact, taking the average performance of the Machine 8 bucket from January 11th to January 27th is 59.89%, even removing GME and AMC from the list the average performance is still 11.40%. The key thing is that our machine learning was able to identify this basket, highlighting it as the 8th largest risk in the market (at the time). It didn’t know that this was going to happen – but using it in portfolio construction would’ve allowed it to help contain the damage.

Asset managers chase risk for big returns, but also, where it’s prudent, seek to reduce it. Our machine learning techniques help surface outsized risk to the institutional investor. Their decision to act on the insights gleaned from machine learning is theirs alone (depending on their portfolio’s specific risk tolerance), but having a tool to highlight baskets of large risk may have helped these hedge fund managers in their decision making.

In our next blog post, we will share examples of how utilizing these machine learning risk techniques helped save live portfolios this month. Stay tuned!