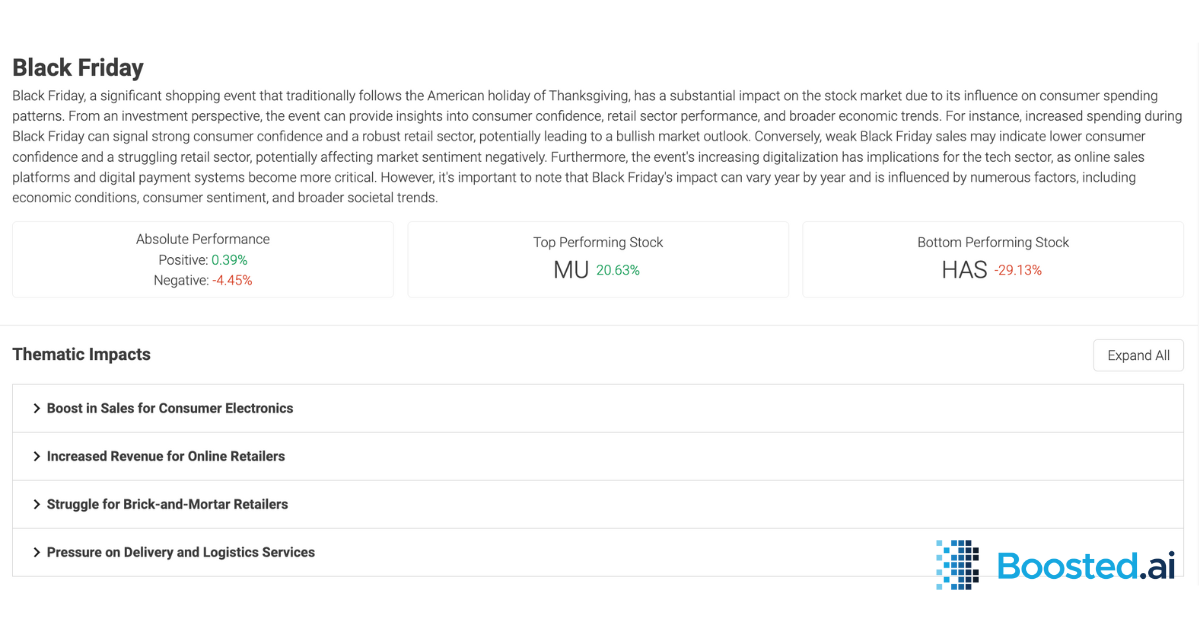

Black Friday – that time of the year we all start thinking about how we kind of maybe do need an 85” TV – is this week, on Friday November 24. Beyond the electronics purchases we probably shouldn’t make, Black Friday is significant for its impact on the stock market. Given its influence on consumer spending patterns, Black Friday can provide insight into consumer confidence, retail sector performance and even broader economic trends. Although its impact can vary year to year, the power of artificial intelligence and large language models (LLM) gives the ability to forecast how Black Friday might impact your equity portfolio. Here, we outline what our artificial intelligence platform for investment management – Boosted Insights – sees as major trends around Black Friday.

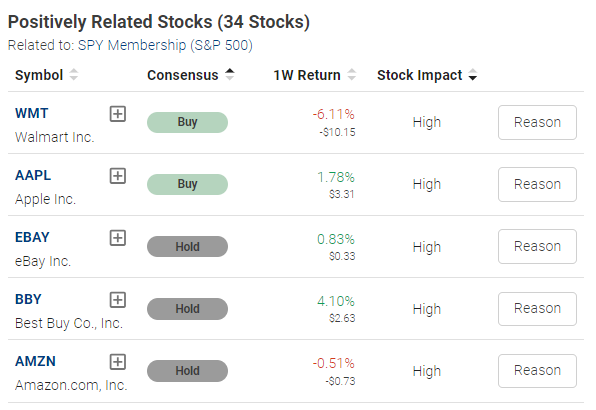

What are the positively related stocks to Black Friday?

Not surprisingly, retail stocks dominate the list here, with Walmart (WMT), Apple (AAPL), eBay (EBAY), Best Buy (BBY) and Amazon (AMZN) coming in the top 5. There are, however, 34 stocks that Boosted Insights’ LLM and artificial intelligence have identified as positively related, and within the list are some more unique picks. Here are some, along with the reasoning why:

- Kenvue (KVUE) – a consumer health company – is expected to benefit from Black Friday as more consumers turn to online shopping for deals.

- CDW Corporation (CDW) – a discrete hardware, software products and services and device company – is identified as having a potential positive impact through a boost in sales for consumer electronics and increased revenue for online retailers.

- Church and Dwight (CHD) – a consumer product maker – should benefit from online shopping as well.

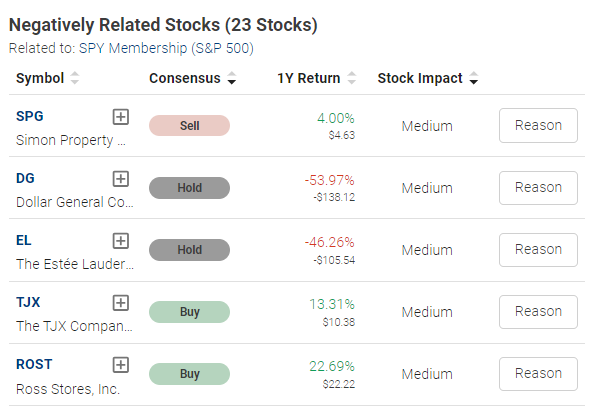

What are the stocks negatively affected by Black Friday?

The main reasoning Boosted Insights has picked up on why stocks might be negatively impacted by Black Friday is due to a struggle for brick-and-mortar retailers. Some of the companies identified are:

- Dollar General (DG) – a discount retailer – which might face challenges due to the difficulties of competing with online retailers.

- The TJX Company (TJX) – an off-price apparel and home fashion retailer – already offers merchandise at a discount compared to full-price retailers. However, the company has a heavy reliance on their physical stores (nearly 4,900 in total), which will also see pressure against online sales.

- The Estee Lauder Companies Inc (EL) – a beauty brand – has a big reliance on in-store sales, in department stores and has a limited online presence. This also presents a problem when it comes to Black Friday sales, which seem to be increasingly happening online.

What are the macro themes around Black Friday?

Investment managers can identify larger macroeconomic themes around topics through our generative AI on Boosted Insights. The themes that Boosted Insights has highlighted as important around Black Friday are:

- A boost in sales for consumer electronics

- Increased revenue for online retailers

- A struggle for brick-and-mortar retailers

- And pressure on delivery and logistics services.

Diving more deeply, that means that:

- companies that sell consumer electronics, such as gaming consoles, televisions, and smartphones, are likely to see a significant increase in sales as consumers take advantage of Black Friday deals

- Online retailers that offer a wide variety of products are likely to see a surge in revenue as consumers turn to online shopping for Black Friday deals.

- Brick-and-mortar retailers may struggle to compete with the deals and convenience offered by online retailers, potentially leading to lower sales.

- And companies that provide delivery and logistics services may face increased pressure and potential delays due to the surge in demand for online shopping.

Within each of these sub thematic impacts of Black Friday, Boosted Insights identifies the stocks that might be positively or negatively related to that theme, and news articles discussing the trend.

Takeaways

Artificial intelligence empowers investment managers with data-rich insights, faster and more efficiently than they could find or create them manually. In doing so, AI also helps supercharge an asset manager’s productivity, saving them time and resources on their research process. Understanding broad themes in the macroeconomic environment is one application of generative AI our investment manager clients are seeing success with. They are able to create custom themes (say, if they were curious what the impact of increasing inflation might be on a specific sector) or use the themes that Boosted.ai populates (like this Black Friday theme, or clean energy regulations, generative AI, falling interest rates, and more). Want to see how using AI can help you find the themes that matter to you? Fill out our demo form here.