Boosted.ai began with a mission: to create the most loved and widely used AI tool for asset management. Since 2017, when we started Boosted.ai, we have aimed to make Boosted Insights – our AI software for investment managers, an easy-to-use tool masking serious complexity and computational power.

I am thrilled to unveil Boosted Insights 3.0 – our most revolutionary update yet, and one that allows investment managers to supercharge their productivity.

Boosted Insights 3.0 takes all that we have learned about how asset managers approach investment management and combines it into one easy-to-use, all-in-one AI-powered platform. We help our users stay on top of everything that matters to them by marrying our proprietary, finance specific generative AI technology with our existing suite of products. Thousands of real time sources of information distilled into easy to understand summaries. The ability to create your own custom research reports with direct impacts on the stocks you care about. All the financial information you need to stay on top of the market – allowing you to do your research with 1% of the effort at 50 times the speed.

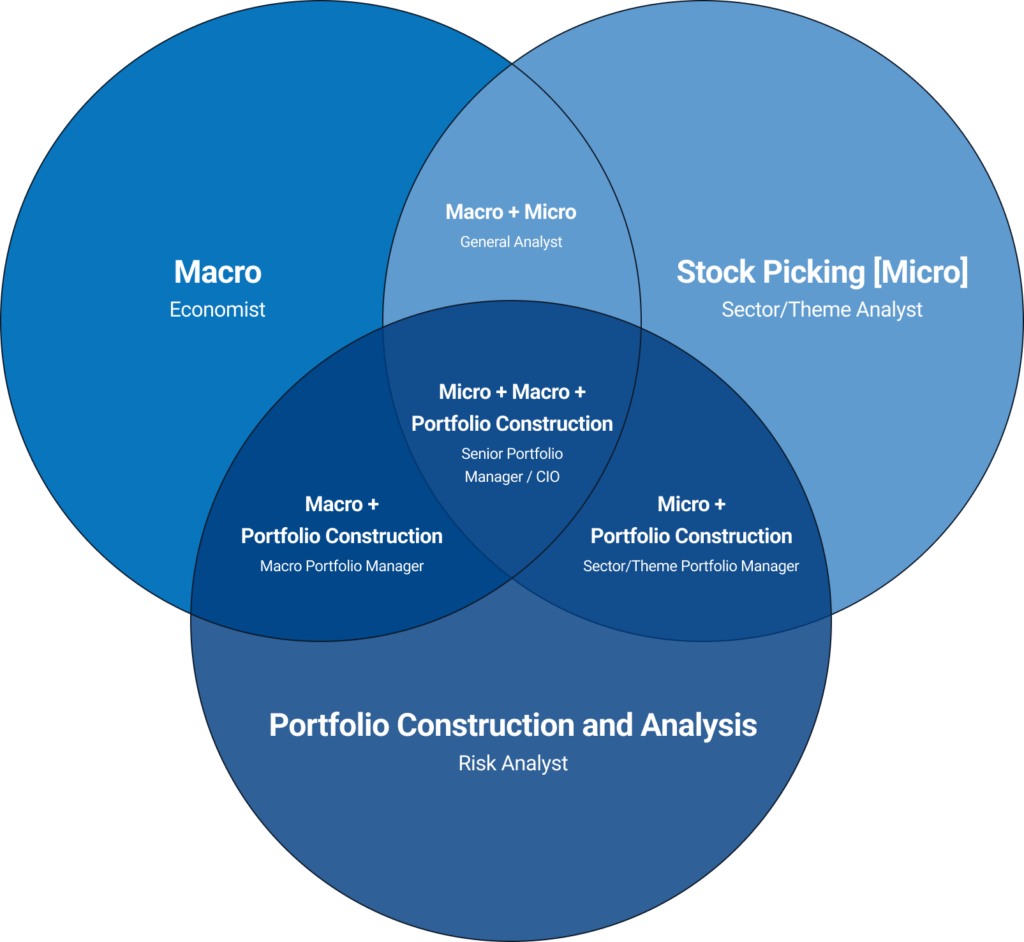

Previous iterations of Boosted Insights have focused on micro – helping investment managers sort winning stocks from losing ones by dynamically ranking every stock in their universe through our proprietary algorithms that pit every stock against every other on a variable by variable basis. These insights were useful for our clients, but we heard from our clients and prospects that being able to incorporate macro would make Boosted Insights even more powerful. They also told us that portfolio risk and construction was a major factor in their decision making. Enter Boosted Insights 3.0.

Breaking Down the Key New Features of Boosted Insights 3.0

Market Trends – macro research, powered by generative AI

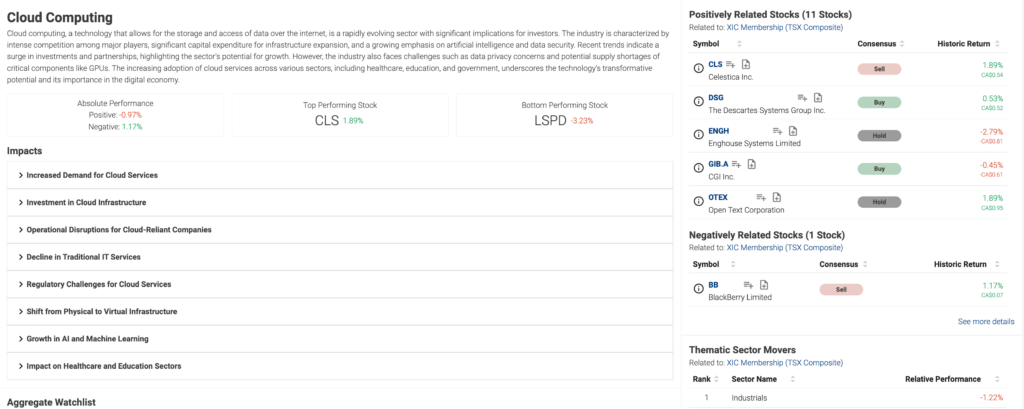

Wouldn’t it be great if someone could read the news for you? With the launch of Market Trends, we empower users to stay ahead of market-moving themes. This cutting-edge feature – powered by large language models and generative AI – sifts through hundreds of thousands of news articles, earnings releases and more to highlight the latest, most active trends that can impact the market and your portfolio. Users can identify stocks positively and negatively affected by these trends, and even create and discover their own custom market themes. Curious what rising interest rates will do to your stocks? What will happen if inflation continues at this pace? What impact a possible recession might have? Market Trends allows you to do that research in minutes, not days.

Market Trends give users the ability to quickly get up to date on any topic impacting markets, as well as seeing which stocks are positively/negatively impacted.

Earnings Calendar – cut through the noise of earnings season with AI insights

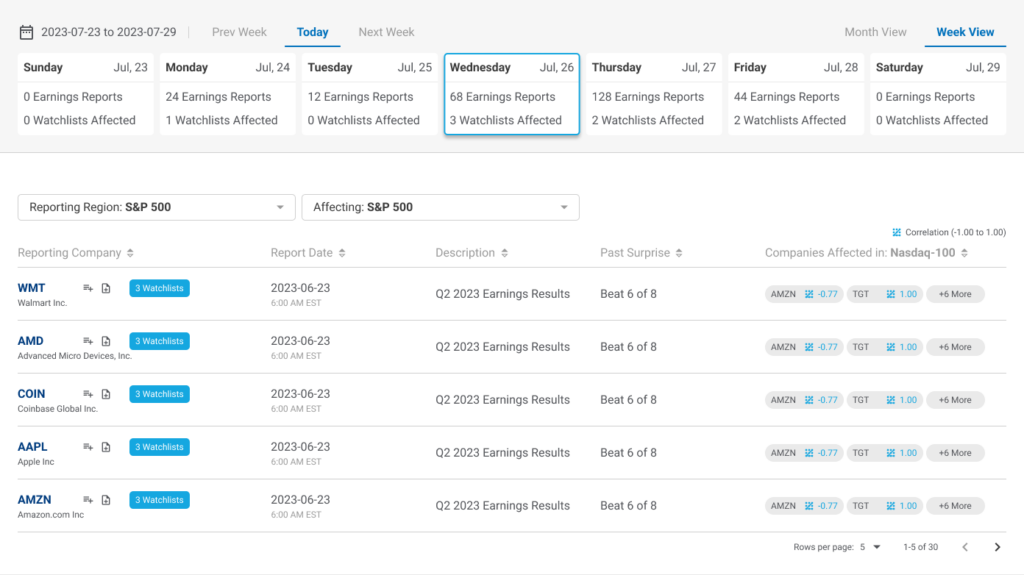

It isn’t enough to know when your stocks are reporting – you also need to know when your stocks can be impacted by other companies. There can be over 80 earnings events impacting your portfolio every quarter. Wouldn’t it be great to have advanced notice of which ones might affect your stocks? Let our new Smart Earnings Calendar do the heavy lifting for you as it constantly monitors the interconnectedness of the market, surfacing the most relevant earnings reports to you. These results save you time and can surface unintuitive links between other companies and your stocks.

Smart Earnings Calendars give users a quick look at which companies have earnings reports upcoming, and which companies are typically affected by these earnings reports.

Portfolio Workspaces – improving risk metrics through data

It’s a question every portfolio manager asks themselves daily – “what risks am I taking in this portfolio and should I be taking them?”. Our Portfolio Workspaces page provides users a comprehensive understanding of the risks they are taking with their investments and assess whether they align with their objectives. Once Boosted Insights understands your portfolio and your goals, all of the recommendations it makes are tailored to your unique investing style and mandate. This saves hours in the portfolio construction process and ensures all recommendations are a great fit.

We also provide detailed Overall Risk Analysis, showcasing a portfolio’s exposures to market factors, and Single Name Risk Analysis, revealing how each holding contributes to portfolio risk factors. Empowered with this knowledge, users can adjust their portfolio weights to make informed decisions and optimize their risk exposure. Our new Investment Style Matching also uses natural language processing to allow users to upload their investment policy statements to ensure their investment mandates are met.

Boosted Insights’ portfolio integrations gives asset managers recommendations based on their specific portfolios and investment styles

Takeaways

Boosted Insights 3.0 is a game-changer, it’s a generative AI powered assistant portfolio manager that can massively accelerate productivity across the investment process. It allows investment managers to save time, reduce risk, and make better decisions. Interested in learning more about how artificial intelligence can help you drive value today? Reach out to us here to get in touch.