Today’s asset managers deal with more regulation and compliance in their industry than ever before. Investment managers, who are bound by a fiduciary standard to their customers by the SEC, need to take extra care to ensure they are adhering to these regulations.

Here, we share how the advent of finance-specific AI software has made it easy for investment managers to quickly and clearly demonstrate their compliance with regulations.

AI helps improve investment advice standards

Asset managers face different regulations and fiduciary responsibilities based on what kind of investment manager they are. For instance, registered investment advisors have a fiduciary duty to their clients whereas investment brokers have what’s called a suitability standard they must adhere to.

Regardless of the specific standard and regulations, all investment managers must essentially ensure that they can prove that all of their investment recommendations hold their clients’ best interests in mind and are made based on up-to-date and accurate information.

This burden of proof placed on asset managers can be onerous and time consuming to adhere to. We have heard from our clients that having point-in-time evidence to back up their suggestions would make their lives easier by saving them the busywork of compiling their research.

AI can provide more complete and accurate market research

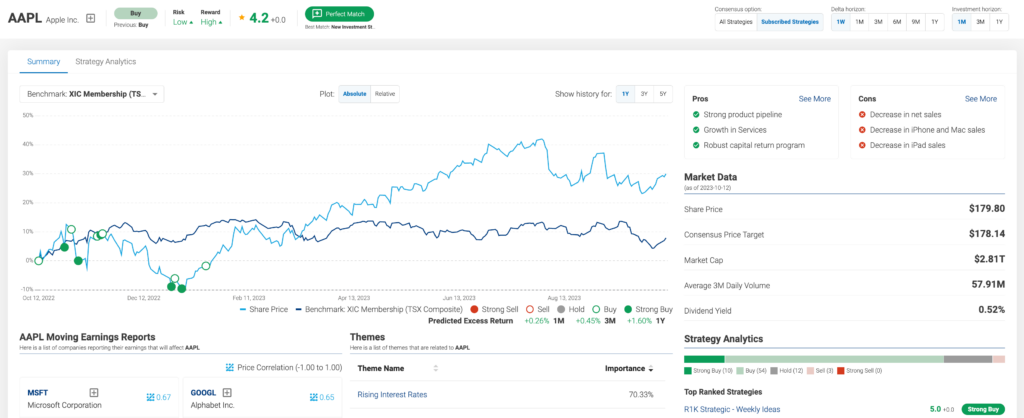

With the right AI tools, investment professionals can demonstrate that their investment ideas are thoughtful and evidence based. AI has exponentially reduced the amount of time investment managers need to spend on research and data-gathering. Think of all the data a manager has to be on top of within their client’s portfolios: macro (interest rates, market moving news), micro (individual stock news, financial reports from companies), portfolio construction (risk appropriate portfolios), and even alternative data like ESG. It’s a lot of work to remain abreast of every potential impact to their clients’ portfolios.

With artificial intelligence, research that used to take weeks to complete can now be done within minutes. With a full 360 view of the market, investment professionals can easily show clients that their recommendations are based on thorough research rather than intuition or on research completed on specific niches within the market.

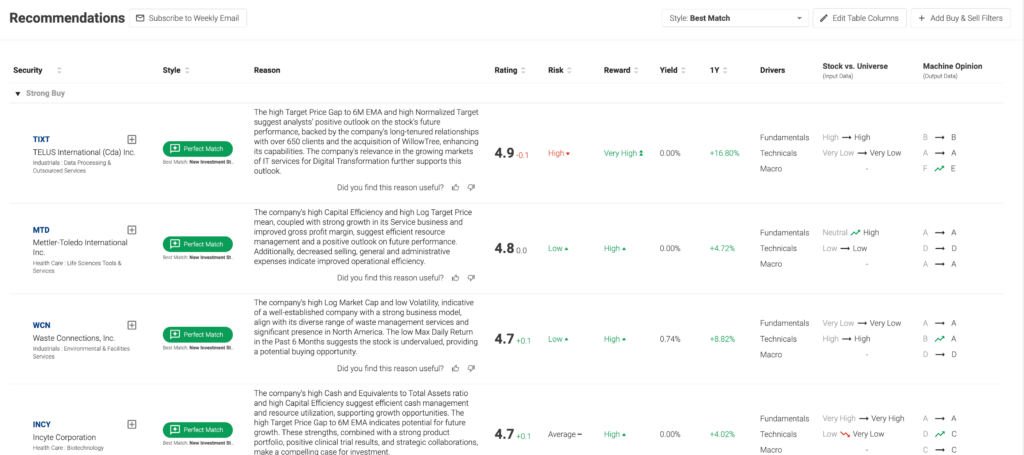

The right AI tools will even generate ideas for investment managers automatically. At Boosted.ai, we factor each manager’s specific portfolio and investing style before recommending personalized buy/sell ideas. With our tool, investment professionals (and their clients) can rest assured that every potential stock in their investment universe was considered from a data-driven perspective and analyzed before a recommendation was made.

AI helps asset managers come to better, more data-driven portfolio decisions

No recommendation impacting a client’s portfolio can be made lightly by an asset manager. It’s essential for investment managers to be aware of each client’s appetite for risk, priorities, and goals before making a recommendation. Folks nearing retirement have different risk profiles than those just starting out in the job market, some people put great emphasis on ESG compliant investing, the risk profile for someone imminently looking to purchase a home looks different to someone with a longer horizon, and so on.

Every time an investment professional recommends that a client enters or exits a position, or changes their risk profile, or updates their sector exposures, these suggestions need to be backed by up-to-date and thoughtful research.

With Boosted Insights, our AI platform purpose-built for investment managers, it’s easy for managers to back all of their recommendations with data pulled from thousands of real time sources of information distilled into easy to understand summaries. These summaries can be saved and exported to share with clients and explain why each recommendation is being made. This gives managers an archive they can access at any time to provide additional context on any recommendations they made in the past.

All of the recommendations made by our algorithms are specific to each customer’s investment profile and style, so managers can clearly demonstrate that their recommendations are tailored to their client’s specific needs. What’s more, these recommendations, since they originate from machine learning algorithms, are unbiased, objective, and backed by data. This helps asset managers remain impartial and avoid conflicts of interest.

Takeaways

Financial professionals face more complexity when it comes to compliance and regulation than ever before. Thankfully, with the right tools, like artificial intelligence, they can save time with point-in-time data that is unbiased, accurate and holistic, allowing them to spend more time focusing on the other aspects of their business. Any investment manager interested in learning more about how AI tools can help them with compliance can reach out to us here.