There are many characteristics that unify our user base of forward thinking asset managers, but none more so than the fact they are extremely time constrained. Portfolio managers simply do not have time to pore over every piece of data on every stock within their universes. Time and time again, our users have told us that they need to quickly decipher the views in Boosted Insights into actionable plans. Our new Equity Info pages make it easier than ever to see what our proprietary AI based strategies think of every stock in an asset manager’s universe.

Here, we break down our new Equity Info page and show how every section adds value to the portfolio manager’s investment process.

Summary

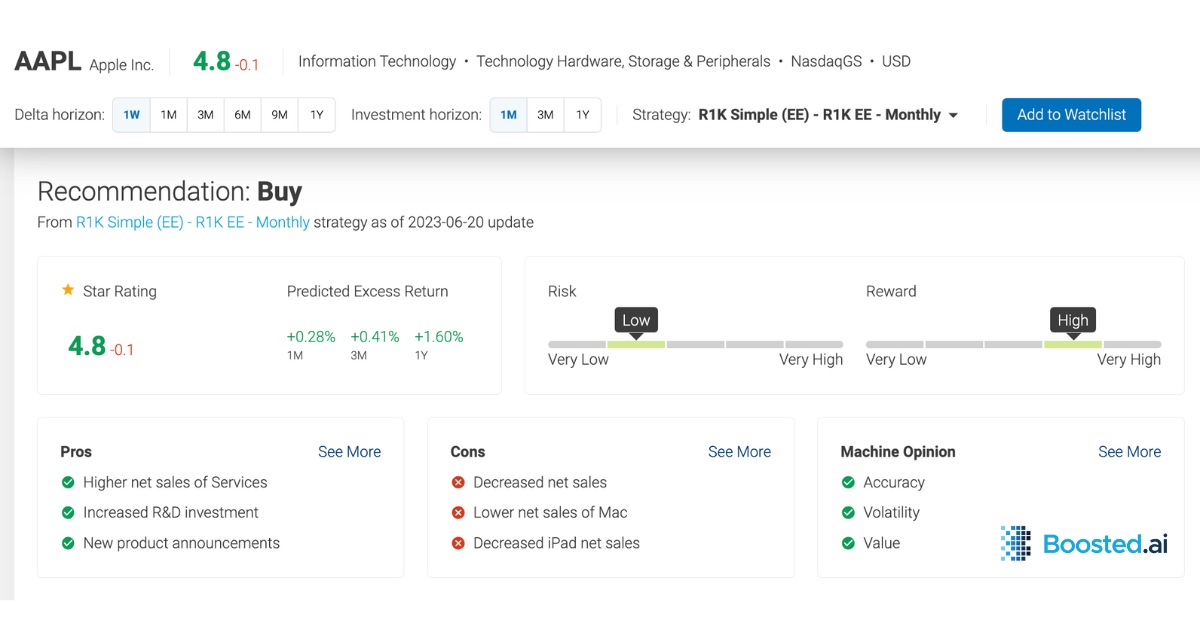

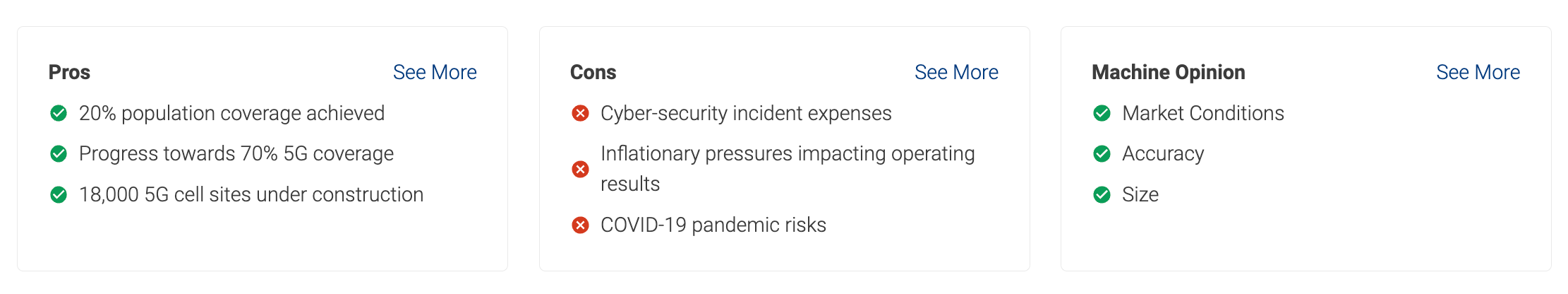

The summary section shows users a snapshot of the specific stock’s rating in their investment universe. We use plain language to describe not only the recommendation (Strong Buy to Strong Sell) but also include risk, reward, and a detailed analysis of the pros and cons of each stock. These help you orient yourself to the stock and give a quick summary of what is important. These pros and cons are now available for all stocks with a market cap greater than 500mm in North America. Here is a sample of DISH Network, where you can see the brief description followed by a more detailed summary.

Strategies

You can customize your experience and the output by selecting strategies that match your investment style. In our strategy library we have dozens of strategies matching various investment universes and styles (think Quality, Value, Growth, etc.) – and if you can’t find something in the library we have the ability to build something fully custom for you.

Historical Price Performance

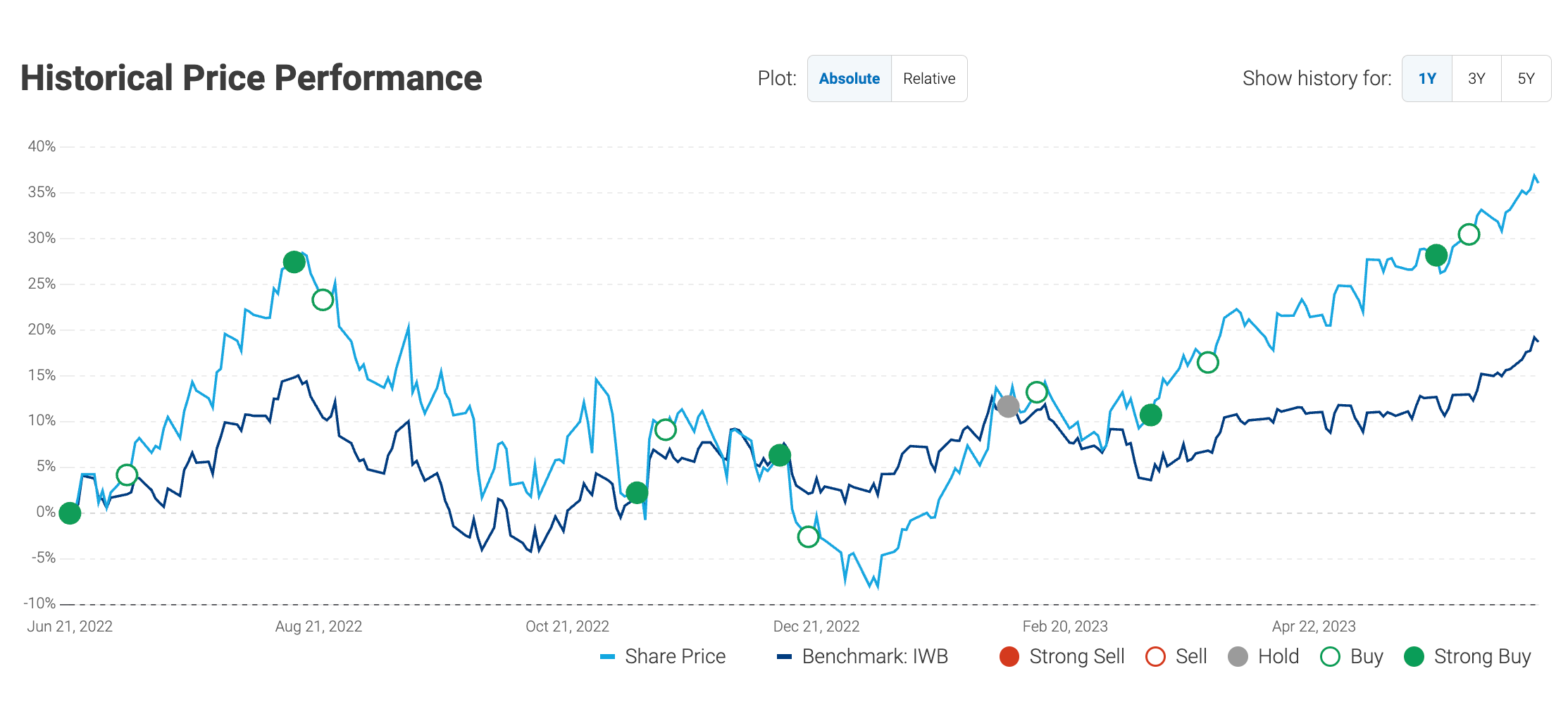

This chart gives users a historical view of a stock’s price performance against its benchmark, and the specific strategy’s generated recommendations. Users get clear visibility into how the Boosted recommendation has performed and changed over recent months. Viewing the historical performance of the strategy’s predictions can help determine whether it’s performant when it comes to predicting this stock.

AI-Selected Comparables

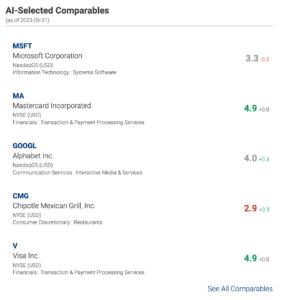

A list of stocks that are similar to the selected stock based on a variety of attributes. AI-Selected Comparables saves you time in your research by surfacing names that have non-intuitive similarities across multiple dimensions. The image below highlights the AI-selected comparables for AAPL.

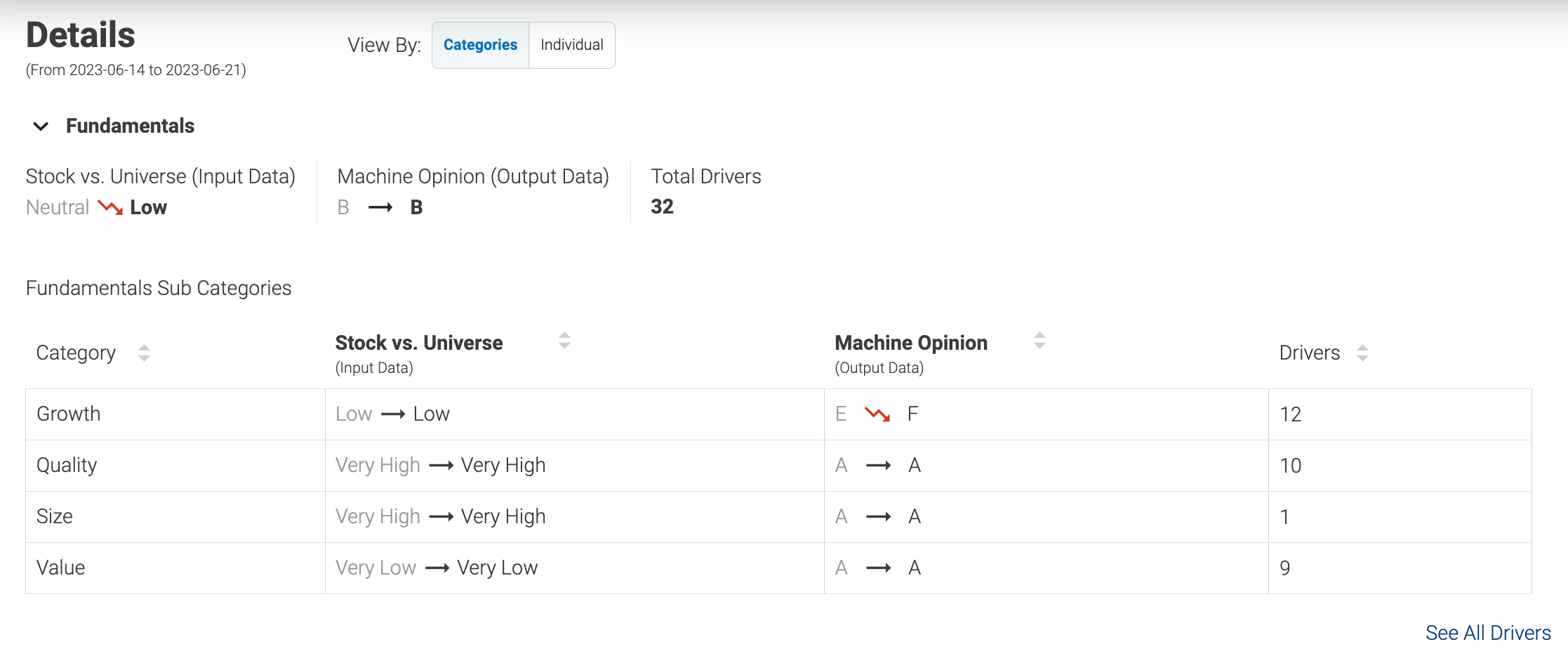

Drivers

Ultimately, the AI is observing millions of data points and training itself to find non-linear connections and patterns. All of which is extremely confusing, and hard to understand. So we have done the work to simplify it and clearly show exactly what is driving the machine’s recommendations – in standard, easy to understand terms. With one extra click you can expand that and see exactly which categories are driving the recommendation. With two clicks you can go down to the level of individual ratios, giving a “glass box” understanding of what is driving each recommendation.

Performance Attribution

Factor attribution helps to explain what is driving the performance of a stock or portfolio. This can help you determine if the stocks gains (or losses) are being driven by stock-specific (Idiosyncratic) variables or factor (Market, Trading Activity, Volatility, Leverage, Size, Value, Growth, Momentum) variables.

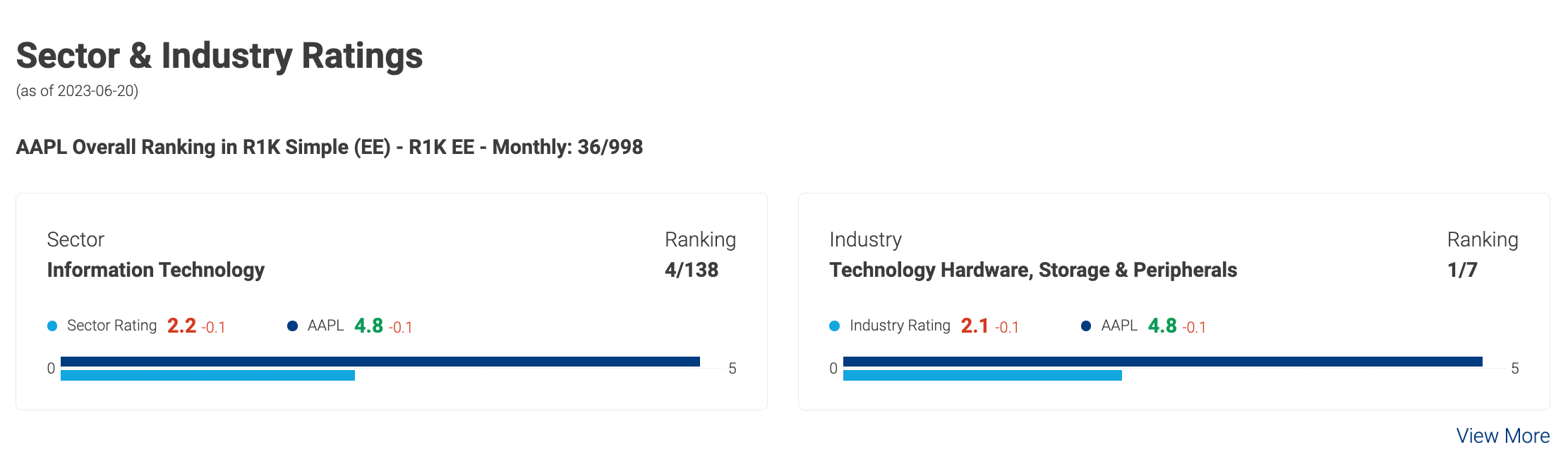

Sector & Industry Ratings

This highlights the stock’s ratings within its sector and within its industry. Comparing a stock’s rating against its sector and industry gives you insight on how this opportunity stack against other candidates.

Takeaways

The Equity Info pages help you understand everything going on with the stock – from qualitative to quantitative and everything in between. The combination of our powerful AI based analysis, glass box understanding, and easy to use interface can really help save you time in evaluating securities.

Interested to hear more? Reach out to us here