In November of last year, OpenAI launched ChatGPT, their artificial intelligence chatbot trained to read a user’s prompt and provide a detailed response. Despite the company’s lack of any real kind of marketing push for the launch, ChatGPT became the fastest growing consumer internet app ever, reaching over 100M unique users in just two months. It took the social media giant TikTok nine months to achieve the same feat!

Clearly, there is a strong fascination regarding the potential of AI technologies. Since ChatGPT’s launch, we are fielding more and more questions about how investment managers can use AI to augment their processes. Here, we’ll outline how AI is being used in the investment industry, what ChatGPT’s strengths and weaknesses are for financial prediction, and why asset managers will want to seek out a finance-specific tool over using ChatGPT.

What is ChatGPT and How Are Investment Managers Using It?

ChatGPT is an advanced language model developed by OpenAI. It utilizes artificial intelligence to generate human-like text responses based on given prompts. Investment managers can leverage ChatGPT to automate scheduling, efficiently manage emails, and handle routine communication. With its natural language processing capabilities, ChatGPT can understand and generate responses, allowing managers to delegate repetitive tasks and focus on strategic decision-making. By acting as a virtual assistant, ChatGPT enables investment managers to optimize their productivity, freeing up valuable time for critical investment activities.

What is the difference between ChatGPT and Finance Specific AI?

In a January webinar, our CEO and co-founder Joshua Pantony outlined how he believes AI will directly impact every industry in the world. The financial industry is one that struggles to integrate AI as capital markets prediction presents some fundamental challenges.

Most consumer facing AI tools like ChatGPT are NLPs (natural language processing), which means they are language models that specialize in text rather than numbers. Processing numeric data may be one of ChatGPT’s few weaknesses. AI systems built for the investment industry need to be able to process large amounts of numeric data to be able to identify trends, make predictions, and respond to market events in real time.

Additionally, the massive amounts of data in the financial industry that artificial intelligence systems need to process in order to make recommendations create a challenging environment for developing valuable AI tools. AI systems built for finance need to be able to deal with large amounts of complicated, constantly updating data. There is a ton of financial data to sift through. It’s an industry known for having a low signal-to-noise ratio. Signal-to-noise refers to the amount of relevant data points within a larger data set. Artificial intelligence algorithms in this industry have to be trained to operate in this type of environment, working to identify what data is important to consider in its analysis and predictions. Language models on the other hand are typically built to take in as much information as possible and use a combination of it to form the answer to user prompts.

Finding the relevant signals within the massive amounts of financial data becomes even more difficult when dealing with real time data and market trends that are constantly in flux. Many NLP tools like ChatGPT don’t have access to real time data and have less noise to filter through when identifying the important signals within the data. There are updates that are connecting these tools to the internet’s live data, but they still don’t have access to the necessary financial data to make recommendations to advisors.

Building AI specifically for Financial Advisors

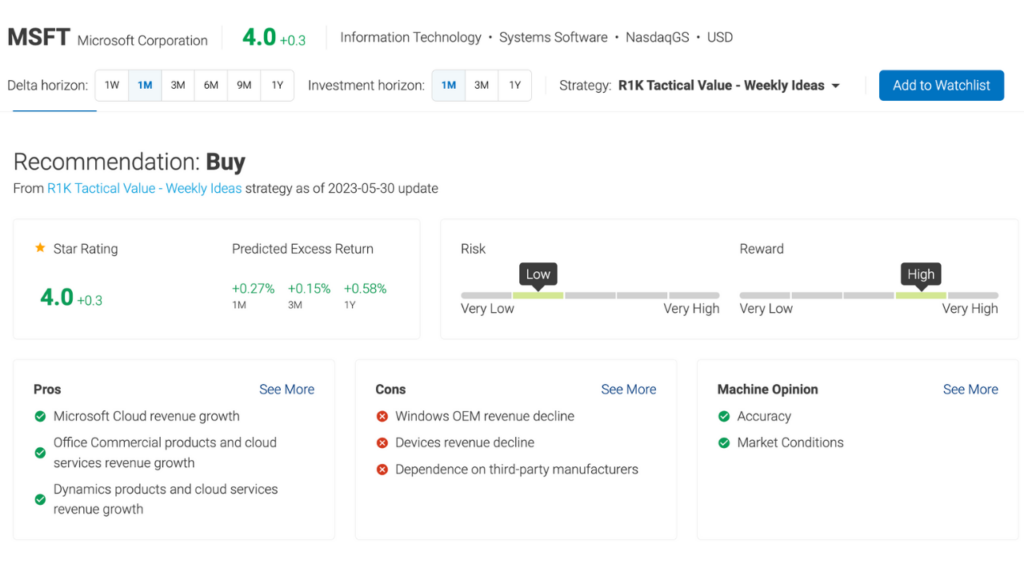

When it comes to serving asset managers, there are a few areas where text based AI models are lacking. Asset managers are looking for actionable insights from their artificial intelligence tools. NLPs like ChatGPT are great at generating text answers to prompts from users, however, they cannot make predictions on future events. Try asking ChatGPT something like “what stocks in the S&P 500 will increase the most on a percentage basis in a 1 year time horizon” and it will say that it doesn’t have the ability to predict stock market performance.

Though constantly improving, NLPs don’t handle numbers as well as AI built for that purpose. It’s possible to “stump” some NLPs by asking complicated math questions. Investment managers need to deal with a lot of math in their day-to-day lives – balance sheets, percentages, volatility calculations, normalizations – finding an AI tool that is purpose-built to handle the rigors of complex mathematics is crucial to their continued AI success.

Financial advisors need AI tools that offer recommendations on specific securities. They also need to have explainability, meaning that the algorithm’s output is well understood. This explainability, often referred to as “glassbox AI”, is essential for asset managers that need to explain their decisions to their firm or their clients.

This explainability is crucial for advisors as NLPs have been known to make up information in the past when it’s unsure. Having access to the machine’s reasoning behind its recommendations gives advisors the confidence needed to follow said recommendations.

Takeaways

Artificial intelligence has created a breakthrough technology that will continue to impact every industry. When it comes to wealth management, AI tools purpose built for investing, versus generic NLP tools like ChatGPT, will create more value for investment managers.

Financial advisors looking to drive success for their business have to demand AI tools that tackle the specific hurdles of capital markets. They are better served with a platform tailor made for investment, that incorporates real-time data, can handle complex numerical equations (including normalizations) and deliver actionable insights as outputs in the form of easy to explain recommendations.

If you want to learn more about how AI insights can help your investment management process, we can help. Reach out to us here.