Technology is advancing at breakneck speeds. We might not be flying in hover cars just yet, but self-driving vehicles, talking robots and intelligent appliances are all very much tech we enjoy today. Artificial intelligence and machine learning are drivers of that technological shift, but it can be difficult to separate fact from science fiction when things move forward so quickly.

Especially in the world of asset management, where nascent technological trends are sometimes slow to be adopted, the use of AI and ML can seem too far out of left field to have any practical applications to an investment manager’s day-to-day process. Here, we’ll break down some common misconceptions about using AI and ML for institutional investors and how all asset managers can make use of this technology, today.

Common Misconceptions About AI For Investment Management

Will investment decisions be made by a robot? I feel more comfortable having people in charge.

We here at Boosted.ai believe the best combination of asset management combines human intuition with the immense computational power of machine learning. Some folks call it quantamental investing and you can read more about it in our blog post.

The idea that human plus machines are best is backed by data – The Harvard Business Review says that while AI and machine learning are exciting new avenues for asset managers to pursue, “The bottom line is that while ML can greatly improve the quality of data analysis, it cannot replace human judgment. To utilize these new tools effectively, asset management firms will need computers and humans to play complementary roles.”

We also know that investment managers bring a wealth of experience to stock picking, which is why Boosted Insights (our cloud-based AI software for institutional investing) works best when an asset manager’s capital markets expertise combines with big data and our proprietary machine learning algorithms. This combination can help managers succeed in implementing AI successfully with lasting results.

We have a 3 to 5 year investment mandate. Can we see value from utilizing machine learning?

A common misconception about using AI for asset management is that it only works on very short time horizons. That is not always the case. The graph below showcases the time analysis of the machine predictions out to almost 2 years in advance. The quantile spread (Q1 – Q5) is still excellent, even 2 years into the future. Quantile spread (more on that here), is how our machine learning algorithms work – putting all the stocks it ranks well in one bucket (Q1) and all the ones it ranks poorly in another bucket (Q5) and going long the high rankings and short (or selling) the low rankings.

Won’t using artificial intelligence increase portfolio turnover?

Some people believe that artificial intelligence software will send their turnover skyrocketing, which is not universally true. We have Boosted Insights users who have AI models with well under 100% turnover. You can read more about how AI optimizers can reduce turnover and even volatility here.

We have found that some of our fundamental analysis type clients even prefer a model with high turnover (in theory, if not in practice) because a model with a weekly rebalance period will provide refreshed ideas for them to bring to their weekly meetings. Our portfolio one-page reports highlight the top upward and downward stock rankings within the user’s universe, which can serve as early flags to do more research on those names.

Won’t using machine learning result in unfamiliar stocks in my equity portfolio?

Getting machine learning working for your institutional investment doesn’t add much value if it finds opportunities in untradeable names. In our white paper on machine learning overlays, we explore how using ML can add alpha (232 bps across three funds) to investment manager’s portfolios, simply by adjusting their position sizing.

Machine learning works best for asset managers when it is laser focused on their needs. Within Boosted Insights, users can set parameters to only highlight what is important to them. Critically, this means that the only stocks that will appear within their AI models are ones that the investment manager has approved. There are even ways to blacklist specific stocks across models, portfolios, or even the entire organization.

If I use artificial intelligence, won’t I not be able to explain to my various stakeholders why I chose a position?

We know that for asset managers, having clear, concise, reasoning as to why they went long (or short) an equity position is of utmost importance. Not just to any investors or shareholders, but to colleagues and bosses as well. No one wants to not have an answer when someone says “why did you buy that?”.

Some artificial intelligence models are “black box”, where the inputs and reasoning into why the machine makes a decision is unclear to the end user. We at Boosted.ai know that these models just won’t fly in asset management, so we carefully undertook making our models as explainable as possible.

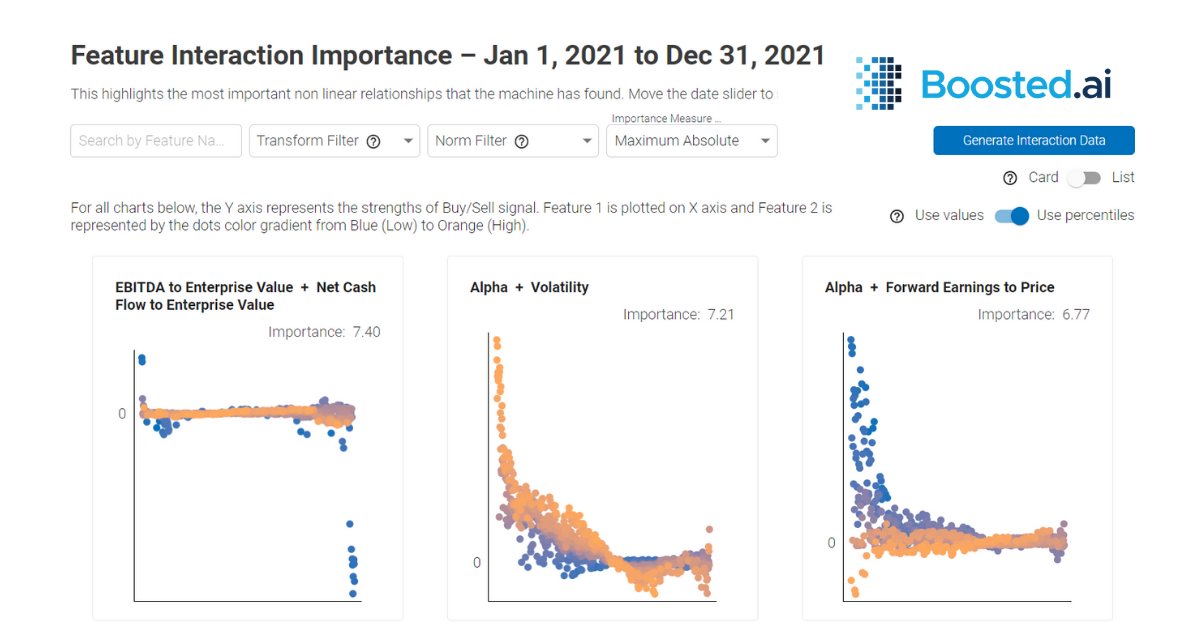

In Boosted.ai models, all inputs are understood and ranked based on their importance in the machine’s rankings. This helps users understand how to trust the model, know how to course correct if they find errors, and explain decisions to their stakeholders. We have also implemented many explainable AI features in Boosted Insights, like Feature Interaction Importance (shown in the opening image), exhaustive (and downloadable) rankings for every stock in the user’s universe, and dynamic word clouds that highlight how much influence each variable had on a particular model.

Takeaways

Every asset manager can use artificial intelligence or machine learning in their process. Implementing AI and ML are ways to generate data-driven insights for equity portfolios, regardless of the investment manager’s mandate. We have helped institutional investors find ways to use AI in their process (for more on that, read on here).

Interested to hear more? Reach out to us here